Accepting Crypto Payments: How to Record Revenue, Fees, Refunds, and Chargebacks

Payments made from crypto can make the process feel smooth and effortless, but sometimes complications may arise during accounting.

Furthermore, fluctuation of prices and fees between checkout can make things disorganized and could cause delays.

In this article, we have outlined some steps that you can take to steer clear of such setbacks and keep your books clean and make the whole process straightforward, as it’s meant to be.

Key Takeaways

- Recording revenue when payment is complete

- Handling refunds the simple way

- Usage of a dispute hold account

- Reconciling orders, statements, and wallets

1. Capture revenue at fair value the moment payment is confirmed

Decide what ‘value’ means in your books, then stick to it, every time. Most teams use the processor’s confirmed timestamp rate because it is traceable and consistent.

Moreover, book gross sales revenue at that fair value, not at what you later convert to cash. Post the offset to a crypto receivable or crypto asset account, depending on who holds the coin.

Additionally, record the crypto quantity, the currency symbol, and the customer’s invoice currency, so you can reconcile amounts quickly. Save the invoice, order ID, wallet address, and the rate source used.

Also, be sure to add simple and useful content on your website to better educate customers on how to get crypto on Kraken and how to safely pay and integrate cryptocurrency as a payment method to your business on your website.

2. Record fees separately so margins stay consistent

Statements may blend service fees, network fees, and conversion spreads. Do not net them against revenue. Create two subaccounts, one for processor fees and one for network fees, and review them each month.

Be sure to also record gross revenue, then book fees to clear expense lines.

If a fee is withheld from the deposit, post it as a separate expense tied to the same batch. If a fee is charged in crypto, record it at fair value on the fee date and reduce the crypto balance.

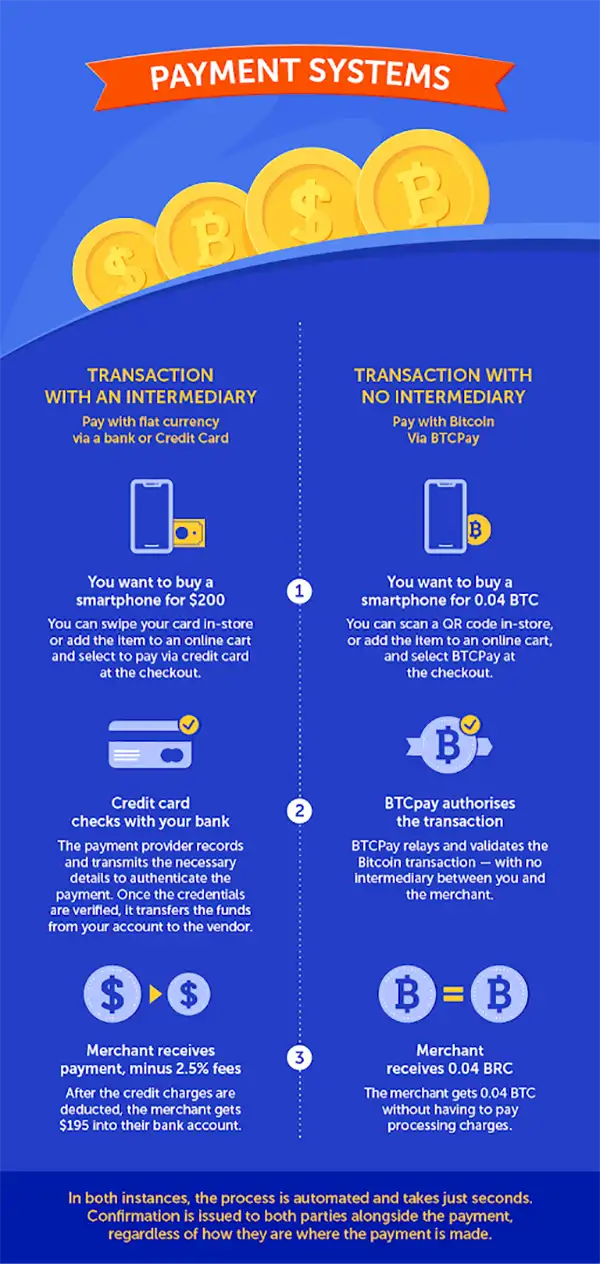

You can better understand the process of how crypto taxes are handled and payments are done and processed with this infographic :

3. Handle refunds with a reversal first, then a gain or loss line

Refunds should follow the original sale trail. Reverse the sale at the original recorded value, then record any difference as a separate gain or loss.

Furthermore, you can post it like this: debit sales returns and allowances, then credit cash for the amount you sent back.

If the refund uses a different rate than the sale, book the difference to digital asset gain or loss. Make sure to store approval notes and the refund confirmation in the same proof pack for the order.

4. Use a dispute hold account for chargebacks

When a dispute opens, move the disputed amount into a ‘disputes and chargebacks’ hold account, even if cash has not left yet.

For instance, if the processor pulls funds from future settlements, clear the hold against that reduction, plus any dispute fee.

If you win, move the hold back to cash or the crypto account. Ensure you attach proof, customer messages, and the case ID.

Did You Know?

Unlike regular banks, payments made by crypto can be done 24/7 across international borders without any middlemen or brokers.

5. Reconcile monthly across orders, processor statements, and wallets

At the end of the month, reconcile three lists: your order report, processor statement, and wallet or exchange export.

For clean reporting, keep one account for digital asset holdings, and remeasure balances using the same close date rate monthly. Match by order ID first, then by timestamp and amount.

In addition, you should flag items that are pending settlement, partially refunded, or manually adjusted. Save CSV and PDF exports in a locked month folder, with a subfolder for disputes. This ensures that any transaction can be explained quickly, with evidence attached.

Final Thoughts

Crypto payments can boost conversions, but messy records quietly erase the win. Keep entries consistent, fees visible, and reversals traceable.

When you can reconcile in one sitting, you can add volume without adding stress. If you are unsure, ask your accountant to confirm the right accounts and policy choices for your business.

Ans: The blockchain technology, which handles crypto payment,s is highly secure and fraud-resistant, and transactions can settle within minutes and do not require the sharing of personal info.

Ans: Definitely, as cryptocurrencies charge much lower fees than other traditional methods. Some bitcoin exchanges even offer under 1% exchange fees.

Ans: It is a service that lets merchants accept payments made by cryptocurrencies. It makes it possible by converting it to the local currency (USD or EUR) instantly to avoid inconsistencies.

Ans: Yes, using a virtual currency for any kind of purchases is deemed as a sale, which requires the user to recognize profits or losses made by such purchases or payments.