The Biggest Financial Mistakes First-Time Founders Make

Handling a business requires managing multiple domains all at once. An inexperienced entrepreneur may falter and make expensive mistakes that can cause major issues for the company in the future.

Moreover, many errors are not obvious and in-your-face but rather hidden, increasing and compounding as time goes on, and are noticed when the damage has already been done.

In this guide, we’ll highlight common mistakes that inexperienced founders make and how you can steer clear of them and take early steps to keep your business prospering and growing for the long term.

Key Takeaways

- Mixing expenses and the finances of the business

- Underestimating the cost of running a company

- Not establishing a proper financial structure

- Scaling quickly without solidifying fundamentals

Mix Personal and Business Finances

It often begins harmlessly, using your personal card to pay for a business tool or depositing a client payment into your own account “just this once.” But mixing personal and business finances is a dangerous habit that quickly creates confusion and risk.

Additionally, when everything runs through one account, you lose clarity. It becomes difficult to track real profits, manage expenses, or prepare accurate reports. Tax season turns stressful, and in serious situations like audits or legal disputes, this lack of separation can even weaken your liability protection.

Moreover, further issues are created when loans are involved. NerdWallet recommends keeping personal and business finances separate and avoiding using a business loan for personal purposes.

As, it can lead to your loan agreement being violated, which can land you in serious financial and legal trouble. Use personal cards and loans for your expenses; this distinction helps protect you and your business.

Underestimate the Cost of Running a Business

Many first-time founders plan for obvious costs like product development, branding, and a website. What they often overlook are the ongoing and hidden expenses that quickly add up.

According to Investopedia, businesses may need health inspections, licenses, and industry-specific permits before they start operating. Insurance is another essential cost. Coverage such as general liability, property, and workers’ compensation protects the company from legal and financial risks and can help safeguard personal assets.

Technological expenses such as websites, software, accounting systems, and POS tools are also necessary. Equipment and supplies must be purchased or leased carefully, depending on cash flow. Advertising, marketing support, and employee wages and benefits further increase costs.

On top of this, experts recommend maintaining a contingency fund of 10 to 20 percent for unexpected expenses. Founders who understand their full cost structure and break-even point are far better prepared for sustainable growth.

Did You Know?

The USA is leading in startup numbers, with most of its concentration in technological hubs, whereas Singapore is a majorly desely funded hub.

Delay Financial Structure Until It Is Too Late

Many first-time founders postpone organizing their finances, assuming they will deal with it after launching or once revenue becomes steady. In reality, that “later” rarely comes, and the delay creates bigger problems.

Without a system, books are only updated during tax season, and professional help is often sought only after compliance notices arrive. This leaves the business operating without a proper budget or forecasting system. Decisions are made without clear cost analysis, leading to confusion, cash strain, and avoidable penalties.

Early-stage businesses benefit greatly from structured bookkeeping. Scharf Pera & Co. notes that financial statement compilations are much easier when working with certified accountants. These experts help founders better understand their numbers and make informed decisions about assets and growth. Professional financial consulting provides the stable foundation needed to support long-term sustainability.

Ignore Cash Flow

Cash flow and profits are two very different things; a business is still bound to fail if cash in hand runs out.

To prevent major problems, one must manage and monitor their payment cycles and cash weekly.

According to the U.S. Chamber of Commerce, you can optimize cash flow using these strategies:

- Streamline payments: Use digital invoicing and multiple payment forms to accelerate collection.

- Adjust terms: Negotiate longer payment windows with suppliers (like net-60) and shorten terms for your customers.

- Control costs: Strategically scale back on expenses, like underperforming marketing channels, instead of cutting them entirely.

- Plan investments: Use forecasting to time big capital purchases for when you have a cash surplus.

Managing these “oxygen” levels ensures your business stays focused on growth rather than survival.

Scale Too Fast Before the Fundamentals Are Solid

Growth feels like success, but premature scaling is a leading cause of startup failure. Expanding aggressively before validating your business model drains capital and destabilizes operations. A McKinsey & Company report highlights that sustaining growth requires nurturing five core areas: talent, culture, planning, leadership, and investor management.

A good founder prioritizes cultural fit, which promotesa positive work environment and focuses on immediate needs over emphasizing what the future holds.

Learn from experts and mentors who can guide you on topics like employee value and workplace management, to ensure your business remains a success.

Finally, choose your board wisely. Misaligned investors can drain the bandwidth needed for critical decisions. By testing and validating fundamentals first, you build a business designed to last rather than one that sprints toward a crash.

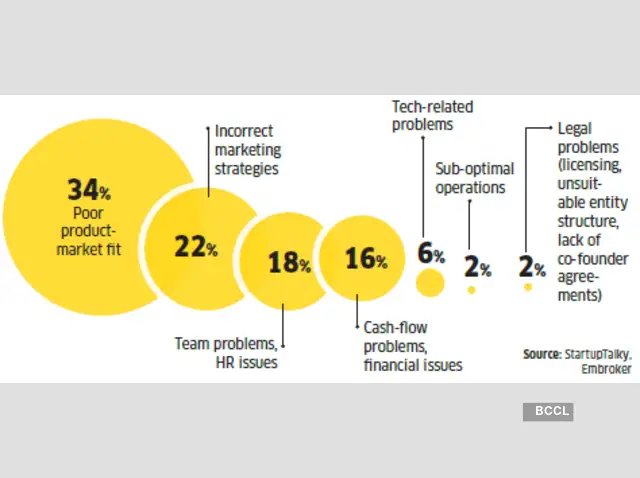

You can learn more about the mistakes new founders make while establishing their business by looking at these statistics:

Conclusion

Building a business is an incredible achievement, but long-term success requires financial discipline. Most startup failures aren’t caused by a lack of passion, but by avoidable mistakes like mixing finances, ignoring cash flow, or scaling too early.

Set up simple structures and see expert guidance right from the start. This is your vision, and you are the only one who can protect it from unnecessary risks.

Lastly, give priority to solid fundamentals and make sure your business is stable and able to grow and adapt even through changing economic times.

Ans: Ideally, from the very beginning. Even before launch, a financial consultant can help you structure your business correctly, forecast costs, and set up systems that prevent costly mistakes.

Ans: Most financial advisors recommend maintaining three to six months of operating expenses as a cash reserve. For early-stage businesses with unpredictable revenue, leaning toward the higher end of that range is smart.

Ans: Yes, recovery is possible, but it requires honest assessment, professional guidance, and swift corrective action. Many successful founders have navigated early financial missteps by restructuring their operations and bringing in financial expertise.