What is Form W4? – Let Your Employer Know About the Withholding from the Salary

Filling out the Form W4 is an important part of starting a new job, as it is used to determine how much money you will receive in your paycheck. It may not look glamorous, but figuring out what is a W4 form is early on will help you a lot in your career, , especially when understanding related topics like the marginal tax rate.

The sooner you get tax accounting right, the more money you can keep in your account with each paycheck and save yourself from paying a huge amount of tax. Read on to understand what it is and how to fill out a W4 form by yourself, while also knowing what happens if you don’t file taxes on time

- What is a W4 Form?

- How to Fill Out a W4 For Dummies?

- What is The Difference Between W2 and W4 Form?

- When Should You Fill a W-4 Tax Form?

- What Happens If You Don’t Submit a W4 Form?

- Common Mistakes People Make When Filing Out a W4 Form

- How to Decrease Withholdings When Filling The W4 Tax Form?

- Wrapping Up

- FAQs

What is a W4 Form?

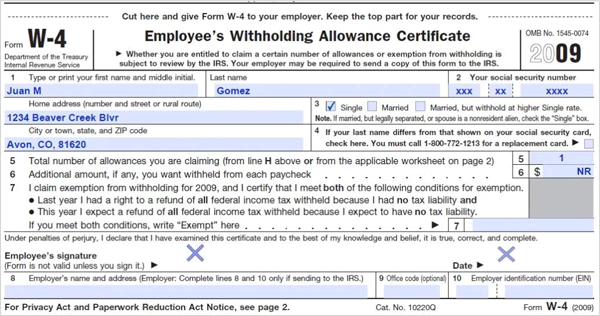

A W4 form is a one-page IRS document you are supposed to submit to your employer when starting a new job. The purpose behind the form is to let your employer know exactly how much should be withheld from your salary to be set apart for federal income taxes, similar to how the NIIT tax works for certain high-income earners

So, what is W4 tax form? It is also called an Employee’s Withholding Certificate, which should be updated every time you start a new job or go through any major changes in life, like marriage, divorce, becoming a parent, or getting a raise. This also includes the case of a new income source, especially if you earn interest or investment income reported on forms such as 5498 tax form.

Failing to fill out the W4 properly can lead to penalties, financial complications such as reduced take-home pay, and a large tax bill. Additionally, errors in your Form W4 can result in IRS audits and payroll issues with your employer, much like filing errors related to the Schedule E tax form

Below, we have explained how you can fill out the W-4 tax form the right way and stay away from any conflicts with the IRS.

How to Fill Out a W4 For Dummies?

Filling out the W4 form can be summarized in a 5-step process. We have explained the steps for how to fill out a W4 for dummies below:

Step 1: Enter Your Personal Information

This step requires you to enter your personal information and let the employer know about your personal life. The information provided by you will be used to determine the tax rate, which will be used to withhold the earnings from your payslip.

You can also compare this with how taxpayers track deductions or business spending, similar to managing petty cash in small businesses.

Here is the information you have to present in the first part of the process:

- Name

- Address

- Marital Status

- Social Security Number (SSN)

- Tax Filing Status

Step 2: Information About Your and Your Spouse’s Income Sources

To determine your standard deduction, you need to include the earnings of your spouse and also reveal if you have any other sources of income, along with their details.

- Enter the details about your multiple sources of income (if you have any).

- Add the earnings of your spouse.

Step 3: Claim Your Dependents

The number of children and dependents you have does affect your tax credit. Filling this section will allow your employer to determine how much credit you will be eligible for when filing your taxes.

Enter:

- Number of children you have under the age of 17.

- Number of dependents you have.

Step 4: Make Adjustments

Here you can include any other income sources from interests, dividends, retirement, etc. The information added here can both increase and decrease your withholdings, depending on the deductions you are planning to take.

Step 5: Sign and Date Your Form

With everything done, you should sign the form and enter the date of filing. You can also use this opportunity to double-check all the details you have put above.

That’s all you need to know about filling out a W-4 document. During the process, you can also use an IRS tax withholding calculator to receive a more accurate withholding amount. After filing the W4, you should check your paycheck to ensure you have done everything the right way and the correct amount is being withheld.

What is The Difference Between W2 and W4 Form?

While the Form W4 is filled by the employee when starting a new job, the W2 form is filled by the employer as a year-end summary of your earnings and withholdings, which is sent to you.

The W2 form can be described as your last year’s scoreboard, which denotes each penny you have earned and each penny you have lost.

Here’s a table to clearly explain the difference between the two:

| Point of Difference | Form W4 | Form W2 |

| Who fills it? | Employee | Company |

| When does it need to be filled? | It is filed when you start the job, and tax regulations are changed. | It is filled at the end of each financial year. |

| Why is it filled? | It gives an overview of how much to withhold from a paycheck for federal taxes. | It is a summary of total wages earned and taxes withheld for the year. |

| Who uses it? | Employer considers it to calculate the payroll of the employee. | The employee utilizes it to submit their income tax return |

When Should You Fill a W-4 Tax Form?

In most cases, you are required to fill out a W-4 form when starting a new job to allow your employer to calculate your tax withholding. Apart from this, you can also fill the form again in case you have gone through any changes in your life, like getting married or becoming a parent.

Even minor changes can have a great impact on how your tax is calculated, and you should be making these adjustments whenever it is necessary.

Here are the situations when you should consider filling out a W4:

- Getting married or divorced

- Becoming a parent (Through birth or adoption)

- When your spouse starts or stops working

- Getting another source of income

- Change in income

- In case you want to make adjustments to your tax withholdings

What Happens If You Don’t Submit a W4 Form?

If you have not submitted your W4 form, your employer is legally required to withhold your federal income tax at the highest rate. In this instance, you will be treated as single with zero dependents, zero credits, and no adjustments on your payroll.

Even without filing a W4, you will receive a paycheck, but this will be extremely painful financially. Meaning, you can be charged 25-40% more tax than what you actually owe to the government out of every paycheck. Since no one wants hundreds of dollars to be deducted from their paycheck, it is always better to do the work early on and learn how to fill out your W4.

Common Mistakes People Make When Filing Out a W4 Form

It goes without saying that people do make mistakes when filing out the W4 form, and it is only when it is too late in the payroll processing that they realize how big a mistake they have made.

To save you the trouble and the money, here are the common mistakes that cost people thousands of dollars each year:

- Not updating after life changes.

- Not including side hustles.

- Claiming kids who are above 17 years of age.

- Failing to include full information on the spouse’s earnings.

- Using the old W4 form.

- Guessing instead of using calculating tools.

- Forgetting to date their forms.

- Not adding new deductions.

- Claiming head of household without qualifying.

- Forgetting to remove the partner after divorce.

- Forgetting to update.

- Not double-checking information after completion.

Form W4 holds a lot of weight in our lives, and you should not take the two-page document to rob you blind. Even a single mistake can cost you a lot, and if you are not in a position to afford them, it is better to learn all you can about W4 forms and fill them the right way.

How to Decrease Withholdings When Filling The W4 Tax Form?

Want to make the most amount of savings when filling out the W4 form? Here are the things you can do:

- Pick The Right Filing Status: Being the head of household and married will decrease your withholdings by 15 to 20%.

- Make Sure to Add Your Kids and Dependents: This needs no explanation, as the number of kids and dependents directly increases your tax credit.

- Don’t Add Side Income: Using the “IRS Safe Harbor” rule, you can put 0 or a tiny amount in the side income section if you owe less than $1,000.

- Claim Big Deductions: Make sure to claim all the deductions you can, as this will help you save money.

- Remove Extra Withholdings: Delete any money you are voluntarily giving away because you added it in the past.

- Submit A New Form ASAP: Fill out a new Form W4 in case of any major life update, and you can end up decreasing withholdings.

Wrapping Up

The W4 tax form is not a chore you should ignore; it is a lever you can use to have control over your earnings. Just take some time out of your schedule to visit the IRS website and fill out a fully optimized form, and you will never regret it.

Do it today if you have been putting it off, and your next paycheck will hit different. Don’t do it, and you will never get the money that is yours. The choice is yours, but the clock is ticking; your wallet should not wait.

Suggested Read: Biweekly Pay: Learn How to Calculate Biweekly Pay, Along With Its Advantages and Challenges

FAQs

Ans: The form W4 is used by your employer to determine how much income to withhold from your paycheck for the federal income tax.

Ans: To fill out your W4 correctly, correctly enter your personal information, including how many income sources you have. Plus the monthly income of your spouse, adjust for extra income or deductions, and sign the form if everything is done the right way.

Ans: Employees are supposed to fill out the W4 form when starting a new job so their employer knows how much income should be withheld from their paycheck for federal income tax.

Ans: In case you have failed to fill out your W4, your employer will be forced to withhold your federal income tax at the highest possible rate.

Ans: If you have made any mistakes while filling out a W4, the IRS won’t fine you. However, your paychecks will be determined according to the information you have submitted, which can lead to a lot of problems down the road.