How Smart Firms Can Structure Excess Insurance for Extreme Risk

Are you thinking about how firms should structure their excess insurance for extreme risk? The answer lies here.

According to Research and Markets, the excess liability insurance market size has grown strongly in recent years. It will grow from $15.89 billion in 2025 to $17.05 billion in 2026 at a compound annual growth rate (CAGR) of 7.3%.

This article, therefore, aims to address how to utilise excess insurance for extreme risks, build an effective excess program framework, and more!

Key Takeaways

- Building an Effective Excess Program Framework

- The Evolving Risk Profile of Workers’ Comp

- Structuring Workers’ Compensation Excess in a Market Correction

- Aligning Excess Programs With Corporate Growth

Building an Effective Excess Program Framework

You shouldn’t increase primary limits without modeling outcomes. That approach often raises premiums without solving the severity risk and ignores it at times.

Instead, you can structure excess insurance above the defined attachment points to utilise it.

This permits you to retain predictable losses while transferring catastrophic layers. The goal is to place coverage where volatility spikes, not where frequency is manageable.

Your self-insured retention (SIR) decision plays a major role in that balance. Underwriters assess this carefully during pricing and capacity decisions. To come up with the right calls.

Carrier Chronicles explains that carriers first decide how much financial risk an employer can absorb before excess coverage applies. It adds that taking on a higher SIR reduces premium costs.

These factors push you to review retention through a financial lens. You should align SIR levels with available capital, not just premium savings.

The bill would raise the cap on workers’ compensation policies priced with excess rates.

It would also exclude certain transitioning policies from the revised cap. The measure would take effect July 1 if enacted.

If implemented, this regulatory change could influence how you design attachment points and negotiate rates.

You should treat your coverage tower as a financial model, not a standard template.

The Evolving Risk Profile of Workers’ Comp

Workers’ compensation now drives many excess placements. Healthesystems reports that specialty medications continue to raise pharmacy costs in complex claims.

Its 2024 data shows that mental health comorbidities extend treatment duration.

Likewise, longer recovery periods increase total medical spend and overall claim severity.

Together, these trends increase total incurred costs. Prescient National notes that excess workers’ compensation coverage applies after defined loss thresholds, limiting financial exposure from severe claims.

This protection becomes critical when losses escalate quickly. A single severe claim can pierce high attachment points faster than expected. Rate movement alone doesn’t reflect true exposure.

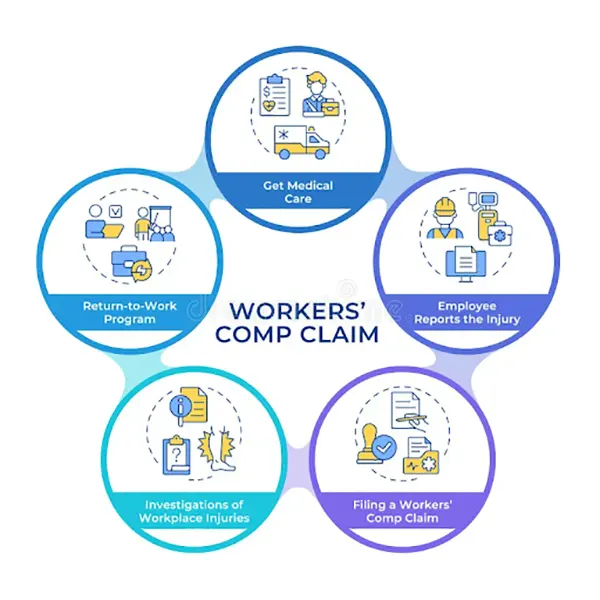

The infographics further depict Worker’s compensation claim :

Structuring Workers’ Compensation Excess in a Market Correction

Insurance Business reports that the workers’ compensation market remains soft through 2026, with continued rate declines expected.

However, states such as California and New York face localized pressure. In these jurisdictions, rising medical severity and inflation are compressing profitability despite overall market softening.

Risk & Insurance reports that property rates are softening in 2026 due to competitive capacity and record reinsurance capital. Global insured catastrophe losses reached about $107 billion in 2025, below the estimated $200 billion. Excess catastrophe policies for flood and earthquake are seeing rate reductions between 25% and 35%.

This signals a split between pricing trends and underlying claim costs. Market pricing may decline while severity risk remains elevated. This creates a disconnect.

Premium relief doesn’t reduce the potential for catastrophic loss. If you ignore severity trends, your excess structure may lag behind real exposure.

You should stress-test attachment points using worst-case medical and duration scenarios. This helps ensure your top layers respond to needed volatility, not temporary market softness.

Fun Fact An insurance policy exists for death by excessive laughter at a movie theater.

Aligning Excess Programs With Corporate Growth

Your excess structure must match your broader financial plan to remain effective.

You can start by defining your probable maximum loss for each policy year.

Then, compare those figures to your retained earnings and available liquidity levels. You must decide exactly how much volatility your balance sheet can tolerate.

If operations expand into new states or higher-risk sectors, your exposure changes. Your coverage tower must adjust immediately to reflect these new operational realities.

Static limits can create blind spots during rapid growth. Review your retention levels annually to ensure they align with capital growth.

Consider how long-tail risks might develop over several fiscal cycles. Excess layering works best when finance and risk management teams collaborate closely.

You need actuarial data and deep capital planning insights to succeed. The final structure should support predictable financial performance.

Regular reviews help you avoid trapping capital in unnecessary premiums. This disciplined approach ensures your risk transfer strategy remains a core asset for the firm.

[

Ans: Excess insurance increases the limit of a specific underlying policy and follows its terms closely. Umbrella insurance can provide broader coverage and may fill certain gaps.

Ans: You determine limits by analyzing worst-case loss scenarios, historical large claims, and industry benchmarks. Many firms also use actuarial modeling to test how a catastrophic claim would affect earnings.

Ans: You should revisit excess limits after major growth, acquisitions, or expansion into higher-risk operations. A spike in claim severity or larger jury awards may also justify changes. Regular program reviews help ensure your coverage keeps pace with evolving exposure and balance sheet capacity.

Ans: An excess is an amount that you must pay towards each claim you make.