NIIT Tax Explained: Meaning, Calculations, and Strategies to Minimize its Taxation Amount

The net investment income (NIIT) tax may seem confusing and stressful at first, especially when you’re hearing about this at the time of filing taxes or planning an investment.

Simply put, the NIIT tax is an extra federal taxation that applies to higher-income taxpayers only when their investment income exceeds the specified IRS threshold limits.

It affects finance like interest, dividends, rental or royalty income, and more, but notably, not all earnings are subject to this taxation.

Therefore, if you want to learn what is the NIIT tax, who is subject to it, and how to calculate your liability, skim through this blog post, as we have talked about this concept in detail.

- What is NIIT Tax? How Does NIIT Tax Work?

- Who is Bound to Pay the Net Investment Income (NIIT Tax)?

- What Does Count as a Subject of NIIT Tax?

- How to Calculate NIIT Tax Accurately?

- How to Report and Pay NIIT Tax Easily?

- What are the Effective Strategies to Minimize NIIT Tax?

- Bottom Line

- Frequently Asked Questions

What is NIIT Tax? How Does NIIT Tax Work?

Net Investment Income (NIIT) tax is a U.S. federal tax that is imposed by section 1411 of the Internal Revenue Code. It is applied at the rate of 3.8% to individuals, estates, and trusts whose modified adjusted gross income (MAGI) and net investment income (NII) exceeded specific statutory thresholds.

Furthermore, this tax was introduced as a part of the Affordable Care Act to generate revenue from high-income taxpayers. It does not affect any other income tax implementation.

Fact: The NIIT tax went into effect on 01 January 2013 for the first time.

How Does NIIT Tax Work?

The NIIT tax applies if your net investment income (NII) or modified adjusted gross income (MAGI) exceeds a certain limitation imposed by the IRS. The net investment income tax rate is fixed at 3.8%.

However, this bracket will be calculated on whichever is lower:

- The portion that exceeds the MAGI threshold or,

- Your total net investment income.

Let’s take an example to understand: Suppose the threshold amounts are:

- For singles, the limit is $200,000.

- For married filing jointly, the limit is $250,000.

- For married filing separately, the limit is $125,000.

Scenario: Single Taxpayer (Threshold Amount is $200,000)

Mr. X has a total wage of around $180,000, and his net investment income is $90,000. This makes his total modified adjusted gross income ($180,000+ $90,000= $270,000)

Consequently, the amount threshold is exceeded by:

$270,000 – $200,000= $70,000.

Thus, the excess amount ($70,000) is less than the NII amount ($90,000), so the net investment income tax will apply to the $70,000 amount.

$70,000 × 3.8% = $2660

This means Mr. X is liable to pay $2260 net investment income tax to the government.

Also Read: What is a K1 Tax Form? How to File a Schedule K-1 Tax Form?

Who is Bound to Pay the Net Investment Income (NIIT Tax)?

Net investment income is subject to a 3.8% that applies to individuals, trusts, and estates when they exceed a certain limit of earnings given by the IRS.

Examine the sections below to comprehend who is subject to the NII tax more precisely.

1. Individuals

The tax bracket is applicable to individuals who surpass the threshold amount. Below, we have mentioned them with their filing status. Check them out.

| Filing Status | Threshold Amount |

| Single | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

| Head of Household (With Qualifying Person) | $200,000 |

| Qualifying Widow(er) With Dependent Child | $250,000 |

Remember, this threshold is not indexed for inflation. Also, if you are an individual who is exempt from Medicare taxation, you still may be subject to the net investment income tax.

2. Trusts and Estates

Both trusts and estates are liable to pay NIIT tax if they have undistributed net investment income and their adjusted gross income (AGI) crosses the threshold restriction, which is $15,650.

Additionally, there are some different computational rules set for some unique trust types, such as Charitable Remainder Trusts, Electing Small Business Trusts, and Qualified Funeral Trusts.

Read More: What is FITW Tax? Explore Components, Benefits, and Challenges of Federal Income Tax Withholding

What Does Count as a Subject of NIIT Tax?

The net investment income tax applies to the individuals’ income, but not all earnings qualify. Below, we have highlighted the subjects that count as NIIT tax. Take a close look.

| 1. Business revenues from commodities or trading financial instruments. |

| 2. Taxable portion of nonqualified annuity payments. |

| 3. Short and Long-Term Capital Gains |

| 4. Taxable Interest |

| 5. Qualified Dividends and Non-Qualified Dividends |

| 6. Royalty and Rental Returns |

| 7. Passive investment income in which you don’t actively participate. |

What Does Not Count as a Subject of NIIT Tax?

After learning what falls under the net investment income taxation bracket, it’s equally important to know what doesn’t. Some specific revenue types are excluded. Below, we have listed them; check them out.

| 1. Unemployment Pay |

| 2. Wages |

| 3. Social Security Benefits or Veterans’ |

| 4. Income from business activities in which you actively participate. |

| 5. Life insurance proceeds |

| 6. Exempt interest from municipal bonds and funds. |

| 7. Exempt interest from the sale of an individual’s primary house. |

| 8. Qualified retirement plan withdrawals. |

| 9. Payouts from a retirement plan, annuity, or traditional defined benefit pension. |

| 10. Payout from the deferred compensation plan. |

Therefore, knowing which earnings count as subject to NIIT tax will eventually help you to understand your deductions better, reducing your overall liability.

Suggested Read: Crypto Tax Calculator 2025: Benefits, Factors, and How a Cryptocurrency Tax Calculator Works?

How to Calculate NIIT Tax Accurately?

Before calculation, remember the net investment income tax rate is 3.8% and is applicable on your NII or the excess amount of MAGI, whichever is lesser, and rises above the threshold. Also, the NIIT tax calculation is done as per the IRS Form 8960 instructions.

We have written a step-by-step calculation method below; take a look attentively.

Step 1: Determine Your Net Investment Income (NII)

Add up all your investment income, such as interest, dividends, royalties or rental income, non-qualified annuities, capital profits from the sale of property, bonds, stocks, and the rest.

Step 2: Consider Allowable Deductions

After figuring out your total net investment income, subtract your expenses like advisory or brokerage fees, investment interest expense, and state/local income taxes.

Step 3: Figure Out Your Modified Adjusted Gross Income (MAGI)

According to IRS Form 1040, your adjusted gross income (AGI), with the amount that has been excluded as an expense (e.g., foreign earned income) from gross revenues, is generally considered your modified adjusted gross income.

Step 4: Check Your Income Threshold

There are several specified categories for different filings. For example, for an individual, the threshold amount is $20,000, and for a jointly filing couple, it’s $250,000. Determine your filing brackets and limitations as per your specifications for further processing.

Step 5: Calculate Your NIIT Tax

If your MAGI surpasses your specific threshold, the 3.8% net investment income tax will be applied to whichever is lesser:

- Your net investment income (NII), or

- Amount of your MAGI

Example: Married Filing Jointly

Let’s assume there is a married couple, Mr. Rome and Mrs. Emily, who jointly file their taxes. They both have a combined wage income of $220,000, and their NII is $60,000.

According to this, the couple’s MAGI is:

Wage Income + Net Investment Income = MAGI

$220,000 + $60,000 = $280,000

Moving ahead, determine the threshold of married filing jointly, which is $250,000. This means the couple’s NII exceeds their specified threshold by $30,000.

As aforementioned, this taxation will apply to whatever is lesser: NII or excess MAGI, and here, Mr. and Mrs. Rome’s modified adjusted gross income is less than their net investment income. So, the NIIT tax will be applied to their excess MAGI ($30,000).

Excess MAGI × Net Investment Income Tax Rate = NIIT Tax Amount

$30,000 × 3.8% = $1140

Thus, Mr. Rome and Mrs. Emily’s NIIT tax liability is $1140.

Also Read: What is a Bonus Tax Rate? How Are Bonuses Taxed and Tips to Reduce Bonus Tax Rate

How to Report and Pay NIIT Tax Easily?

To pay your net investment income tax, you must calculate your tax liability amount according to the IRS Form 8960 instructions. After that, record your total taxation amount on your primary income tax return records (generally, it’s IRS Form 1040).

Below, we have illustrated the detailed procedure of how you can easily pay and record your NIIT tax. Go through the section attentively.

1. Check If You are Subject to the NIIT Tax

This taxation is only applied to higher-income taxpayers who have exceeded their IRS threshold limit. Calculate your net investment income and modified adjusted gross income to determine whether you are liable for the NIIT tax or not.

For this, you can take the assistance of a professional to get year-end accounting services, who will not only help you stay 100% audit-compliant but also create IRS-ready reports.

2. Calculate Your Net Investment Income Tax Liability

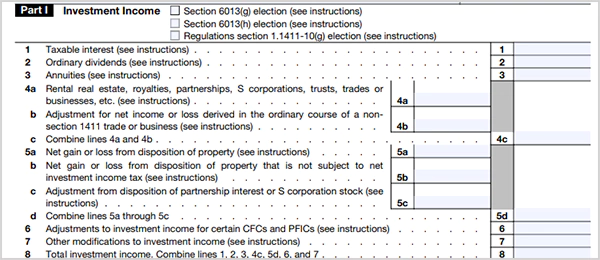

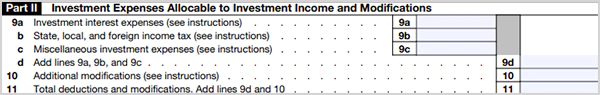

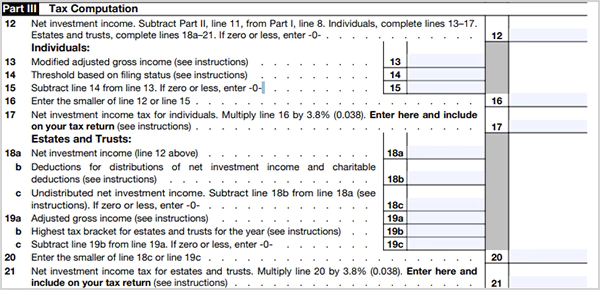

To accurately determine your NIIT tax amount, use the official IRS Form 8960. This form has three different parts:

- Part I: Investment Income — In this section, list all your investment income precisely.

- Part II: Investment Expenses Allocable to Investment Income and Modifications — This portion is to mention your deduction amounts, such as investment interest expense, state/local income taxes, and brokerage fees.

- Part III Tax Computation: The final part of the form is to calculate your exact liability for taxation. Remember, the 3.8% tax will be applied to whichever is the lesser of your excess MAGI or net investment income.

3. Report Your NIIT Tax

The final amount you have figured out from the IRS Form 8960 instructions needs to be transferred to your primary income tax form:

- For Trusts and Estates: The net investment income tax amount will be recorded on Form 1041.

- For Individuals: Determined taxation amount will go under Line 17 under “Other Taxes” on Form 1040.

Also, do not forget to attach the completed Form 8960 to your tax return at the time of filing.

Pay Your NIIT Tax

There are three different ways to pay off your net investment income tax liability:

- Pay With Your Income Tax Returns: This is the most convenient option for taxpayers. You can settle your NIIT tax amount with the annual revenue (IRS Forms 1030 & 1031), reducing paper and manual work.

- Quarterly Estimated Tax Payments: The established companies that are liable to pay a large amount to pay off their taxes are more likely to opt for this option, avoiding underpayment penalties.

- Tax Withholding: By employing this method, you can arrange to have an extra federal income tax withheld from your income sources throughout the year, rather than making separate quarterly estimated tax payments.

Lastly, for any further information or to make an online payment of your taxes, you can visit the IRS official website.

What are the Effective Strategies to Minimize NIIT Tax?

If you want to minimize your tax obligations, concentrate on reducing your modified adjusted gross income or net investment income. Below, we have mentioned how to do so. Take a look.

1. Reduce Your MAGI

As aforementioned, the NIIT tax only applies when your modified adjusted gross income exceeds the threshold limit. Reducing MAGI is one of the simplest and most effective ways to minimize your taxable amount. For that:

- Increase Your Pre-Tax Retirement Contributions: Try to allocate funds to tax-deferred accounts, such as a SEP IRA, 403(b), or 401(k), which will help you to reduce your current MAGI.

- Employ Health Saving Accounts (HSAs): If you have a high-deductible health plan, contributing to it is one of the powerful ways to reduce MAGI, because the money grows, or you withdraw it for a qualified health expense, is tax-free.

- Claim Above Line Deductions: The deductions, like educator expense, student loan interest, self-employed health insurance premiums, and the deductible part of the self-employment, help you to reduce your AGI, which eventually lowers MAGI.

- Manage Finance Strategically: Leveraging tax accounting measures, such as investing in tax-advantaged vehicles, tax-loss harvesting, or considering Roth IRAs/401(k)s for the future, will help you to bring MAGI under your specific threshold.

2. Reduce Your Net Investment Income

If your MAGI still surpasses the threshold limit, you can try reducing your NII and save your money from taxation. Here, we have mentioned some useful techniques; check them out cautiously.

- Contribute to Tax-Exempt Shares: The income you generate from the municipal bonds is generally not included in federal taxes. Thus, the earnings won’t be added either to your MAGI or NII.

- Tax-Loss Harvesting: Another beneficial way is to strategically spend your funds to settle the losses, by which you can offset your gains throughout the year.

- Donate Appreciated Assets: Transfer your honored securities to the designated charity, instead of selling stocks or donating the cash profits. This will give the charity full value and help you to avoid extra taxes.

- Eliminate Allowable Expense: Try to deduct all the expenses related to investments, like brokerage fees, state/local income tax, investment interest, and the rest.

In essence, by strategically spending and investing your finances, you can minimize your NIIT tax liability.

Bottom Line

In a nutshell, understanding and calculating the net investment income tax doesn’t have to be a hectic task. Once you know what earnings to include or exclude, when they apply, and how to minimize them, you can make your financial decisions confidently.

Moreover, if needed, you can also opt for the professional accounting service or cash flow management service, so that with the right knowledge, you can avoid the potential risks of high taxation.

Next Read: Corporate Accounting: Definition, Importance, Types, and Career Potential in 2025

Frequently Asked Questions

Ans: The IRS has imposed a fixed rate of NIIT tax that is 3.8%.

Ans: Yes, there are several exemptions included in this taxation, such as wages & salaries, retirement benefits, social security benefits, and many more.

Ans: Yes, this taxation is one of the permanent additions to the U.S. federal taxes, which only applies to the higher-income taxpayers when they exceed the threshold limits.

Ans: You can legally minimize your tax amount by smartly managing your net investment income and modified adjusted gross income. For instance, leverage tax credits, maximize retirement contributions, utilize health savings accounts, and more.

Ans: This taxation is for higher-income taxpayers, such as individuals, trusts, and estates, who exceed the specific IRS threshold amount.

Sources: