Payroll Tax Deadlines and Common Filing Mistakes: A Practical Guide for Owners

Being a routine administrative task, payroll tax filing seems to be a chore that can’t go wrong. But that isn’t always the case.

Mistakes can happen as a function of the rules being complex and picky, and the anxiety around fast-approaching deadlines. Just a small, early error can cascade into notices, then penalties, and whatnot.

Big enterprises have robust systems, but many small and medium businesses suffer from this problem. Yahoo Finance reported that more than 80% of them blunder in filing payroll taxes, and half of them get penalized for that as well.

If you run in-house payroll using a basic payroll tool or have hired a part-time bookkeeper, this guide will prepare you for tax reporting well before the due dates. Even if you are a careful business owner, you should read this article to avoid any mistakes that can trip you up.

KEY TAKEAWAYS

- Payroll tax filing process can seem simple, but it isn’t.

- It has a scope for potential mistakes across the process, from deposit to returns.

- You should be clear about the amount and due dates.

- To avoid all mistakes, follow a repeatable routine for filing payroll taxes.

Know What’s Due, and When It’s Actually Due

Are you also like, “We file quarterly, so we’re fine.” If yes, beware. Your laxity can lead to mistakes. Filing and depositing aren’t the same thing. Many businesses must deposit withheld income tax and the employee/employer share of Social Security and Medicare throughout the quarter, then report it on a quarterly return.

The IRS lays out deposit schedules (monthly vs. semiweekly) and the general rhythm for employment tax due dates. It’s worth bookmarking the official guidance and checking it when your payroll changes, you grow, or you switch providers. The rules are straightforward, but only if you’re using the right schedule for your business. See the IRS overview here: employment tax due dates.

A practical tip: treat payroll taxes like a standing appointment, not a “whenever we have time” task. Pick one day each pay period to reconcile gross pay, withholdings, and employer taxes against what your payroll system says you owe. If the reconciliation happens only at quarter-end, you’re basically hoping nothing drifted.

The Deposit Schedule Mistake That Causes Most “Surprise” Penalties

Following the wrong deposit schedule stands as the most common mistake in payroll tax filing. Many people don’t even realize when it changed. A business that starts small may be a monthly depositor, then later shift into semiweekly rules based on prior tax liability (“lookback period” rules). If you keep depositing on the old cadence, you can be late even if you pay everything in full.

This is where owners benefit from a simple operating rule: whenever you add headcount, change pay frequency, or take on a new type of worker, revisit your deposit schedule and who is responsible for the deposit. If you’re not sure where that responsibility sits (you, your payroll provider, your bookkeeper), clarify it in writing.

And if you want a clean, low-drama setup—especially when payroll, bookkeeping, and compliance are split across different people—working with an accounting firm in Washington can help you keep the deposit workflow and documentation consistent from payday through quarter-end reporting.

Quarter-end Filing Errors That Show Up Months Later

When deposits are ok, the returns can go wrong. That too triggered by just some small mistakes. Here are the filing mistakes that create “why are we getting this letter?” moments:

First, returns that don’t reconcile to payroll reports. Your Form 941 totals should tie to your payroll register for the quarter. If they don’t, don’t “round until it fits.” Track the mismatch. It’s usually a voided check, an off-cycle payroll, fringe benefits taxed differently than expected, or a timing issue between pay date and check date.

Second, incorrect treatment of tips, taxable benefits, or reimbursements. A restaurant that misses tip reporting, or a professional services firm that mixes taxable and non-taxable reimbursements, can understate wages subject to tax. That error often sits quietly until a later audit, a W-2 mismatch, or an employee question.

Third, mixing contractors and employees without clear classification rules. This isn’t just a payroll topic, but the downstream effect lands on payroll tax compliance. If you’re paying people like contractors but treating them like employees operationally, you’re carrying risk you can’t “fix” at the end of the year with a quick form.

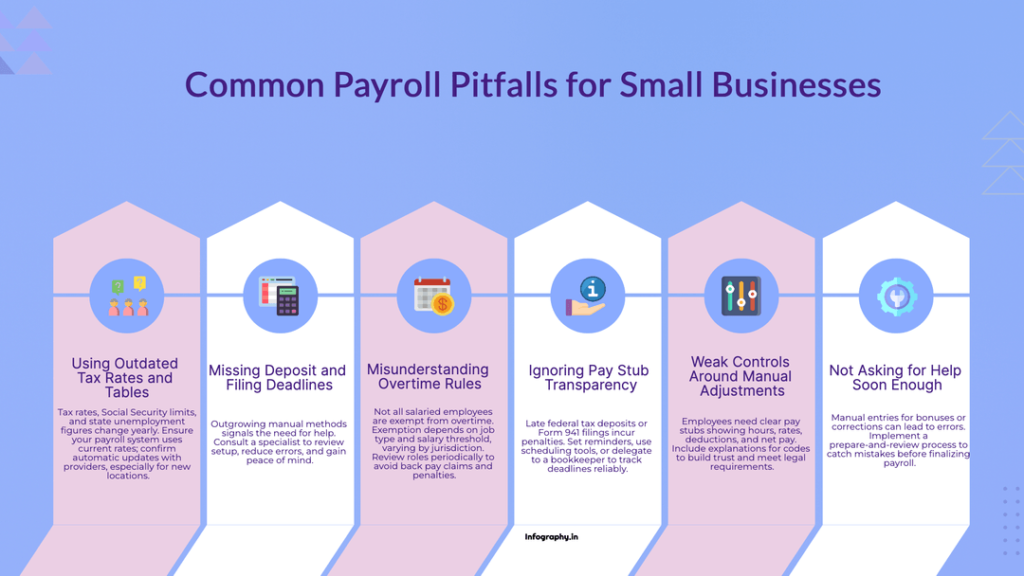

This is common in many small firms. The following infographic lists all other mistakes that are prevalent in them, which lead to tax pitfalls:

Build a Payroll Tax Routine You Can Repeat Every Quarter

Simplifying this complicated process is the best way to avoid all mistakes. Just formulate a repeatable routine to file payroll taxes, and you are good to go.

Start by making sure you can answer three questions at any point in the quarter: (1) What have we paid employees in gross wages so far? (2) What have we withheld and deposited so far? (3) Do our payroll reports match what the bank shows actually left the account? If those three line up, quarter-end becomes a filing task, not a forensic investigation.

A simple example: if you run payroll every other Friday, block 20 minutes the following Monday to verify the deposit date, confirm the tax amounts recorded by your payroll system, and save supporting reports to a single folder for the quarter. It’s boring, but it keeps your future self out of trouble.

Takeaway: Payroll tax compliance is less about knowing every rule and more about sticking to a steady routine—verify deposits as you go, reconcile before you file, and quarter-end stops being a scramble.

In conclusion, I would only say that don’t underestimate a routine task like tax filing as unimportant. Early mistakes can become a real headache later, so be vigilant during the whole process. Keep everything clear about the figures: what’s due and when. The main phases that are prone to errors are depositing and returns; focus on them. Lastly, just make a repeatable SOP so the scope of mistakes is minimized forever.

Clear, Compliant, Correct! Happy Tax Reporting.

Ans: The most common mistakes pertaining to tax filing are: misclassifying employees as contractors, missing deadlines, and inaccurate bookkeeping.

Ans: IRS considers inconsistent, late, or missing filing as red flags.

Ans: Accurately calculate and file payroll taxes on time to avoid penalties.