What is Tax Lien Investing? A Complete Beginner’s Guide

Real estate has been a popular way to grow wealth. However, investing in property is not the only option for you. Tax lien investing offers another way to earn good returns, often with lower barriers to entry. For those managing finances, professional payroll accounting services can also help track investments and cash flow efficiently.

In 2026, the total value of tax lien sales increased to $5.02 billion (across the United States). This indicates a growing investor interest in the asset class. Smart investors often integrate strategies like cash flow management services to monitor returns from various asset classes.

So, if you want to diversify your portfolio and explore alternative investments, here is everything about tax lien investing for beginners. I will explain how tax liens work, what to watch out for, and how to invest smartly. Businesses and startups can also benefit from accounting services for startups to plan their investments better.

Key Takeaways

A tax lien is placed when a property owner fails to pay property taxes.Tax lien investing allows you to invest in real estate without buying property. Investors can purchase tax lien certificates at public auctions.Investors can earn interest and penalties from the property owner.Rules vary by state, and not all states allow private investors to buy tax liens.

- What is Tax Lien Investing?

- How Does Tax Lien Investing Work?

- Why Should You Consider Investing in Tax Liens?

- What are the Potential Risks of Tax Lien Investing?

- How to Invest in Tax Liens?

- Is Tax Lien Investing a Good Idea for You?

- Tips to Maximize Your Returns on Tax Lien Investment

- Tax Lien Investing vs. Tax Deed Investing

- Final Thoughts

- Frequently Asked Questions (FAQs)

What is Tax Lien Investing?

We know that when someone owns property, they must pay property taxes regularly. However, if they don’t, the local government can place a tax lien on their property. A tax lien is a legal claim that says, “You owe us money”. The property owner must pay back the tax liability (with any interest or penalties) to remove this lien.

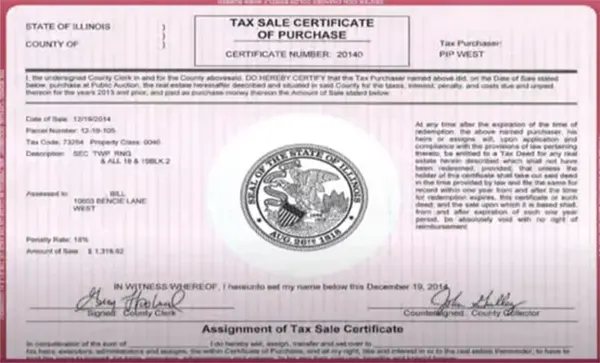

But what is a tax lien investment? Local governments sometimes sell these tax liens as tax lien certificates in public auctions. When you buy a certificate, you need to pay the unpaid taxes. In return, you have the right to collect the debt from the property owner.

Similar to receivables financing, tax lien investments ensure that the government gets the money they are owed in time. For investors, it is an opportunity to earn interest when the property owner repays their taxes.

Also Read: What is the California Exit Tax? How Does the Exit Tax Affect Residents?

How Does Tax Lien Investing Work?

Tax Liens Investment means you have the right to collect the unpaid taxes, plus interest and penalties. Each state has its own rules. So, I would advise you to check local laws before starting. If you’re investing in multiple assets, consider professional year-end accounts services for accurate reporting. Here is how all of this works:

- When a property owner misses their property tax payment, the government places a lien on their property.

- Sometimes, governments sell tax lien certificates at auctions (either in person or online) to get the owed taxes quickly.

- Now, Auctions may use a cash bid (the highest bidder wins) or an interest rate bid (the lowest interest rate wins). However, it is important to note that a lower interest rate means less profit.

- If you win the auction, you need to pay the tax amount on behalf of the property owner. This does not give you ownership of the property yet, but the right to collect the amount and interest from the owner.

- If the owner does not pay, you may have the right to start pre-foreclosure, depending on state laws.

However, foreclosures are rare, as most owners pay to avoid losing their home. They mostly happened with vacant or abandoned properties.

Why Should You Consider Investing in Tax Liens?

Investing in tax liens can be a smart way to grow your money without the usual hassles of real estate, like managing tenants or reselling. It is important to understand the tax lien investing pros and cons. So, here are the reasons you can consider to invest:

- Passive investment: If you work with a real estate professional or tax lien investment companies, you don’t need to attend auctions or hunt for properties yourself. You can earn interest while sitting back.

- Low capital requirement: You don’t need a lot to start. Some tax liens can be bought for just a few hundred dollars.

- High returns: Tax lien interest rates are usually higher than regular savings accounts or bonds, which means your money can grow faster.

- Chance to acquire property: If the owner does not pay their taxes, you may get the right to foreclose or own the property at a lower price than market value.

- Priority claim: Tax liens take precedence over other debts, so if the property goes into foreclosure, you will be among the first to get paid.

- Portfolio diversification: Tax Liens Investing is different from stocks or bonds, which can help you balance your investment portfolio and reduce risk during market swings.

Also Read: What is Medicare Tax? How Should Employees and Employers Pay Medicare Tax?

What are the Potential Risks of Tax Lien Investing?

Like any investment, tax liens come with risks. It is important to understand them before getting started. So, let’s see: what are the disadvantages of tax lien investing?

- Repayment uncertainty: Many property owners pay on time, allowing you to earn good interest. But if they can’t pay or go bankrupt, you may have to deal with foreclosure and other legal processes.

- Property issues: If you end up with a property, it could need repairs and maintenance. If it is in a poor location, it will also affect its value.

- Extra costs: Sometimes, you may need to pay additional liens, as new liens take priority over older ones.

- Legal challenges: Foreclosure and lien procedures can be complicated and may require you to hire a lawyer.

- Redemption periods: Owners usually have time to repay the debt, during which their money is tied up without earning extra returns.

Furthermore, popular properties usually attract various bidders, which can raise the cost of investing in tax liens and lower your potential profits.

Also Read: What is a Bonus Tax Rate? How Are Bonuses Taxed and Tips to Reduce Bonus Tax Rate

How to Invest in Tax Liens?

We have understood that investing in tax liens can be a great way to earn returns, but how can you start investing? So, let’s understand the process; here are some of the best ways to get started:

Attend Public Auctions

As mentioned earlier, local governments often hold public auctions, either offline or online, where you can invest in tax liens. Regularly check your county or city’s official website for dates and rules.

Buy Directly From Municipalities

Sometimes, unsold liens are available for direct purchase. Just contact your local tax office to see what is available at that moment and understand how to buy.

Use Online platforms

Some websites focus on tax lien investment, allowing you to bid from anywhere in the world. This makes it easier if you can’t attend local auctions.

Tax Lien Certificate Investing

Another great option is to purchase tax lien certificates. Certificates from previous auctions may be cheaper and still offer good returns if the property owner repays the taxes.

Contact a Broker or Company

Tax lien investment companies and Brokers specializing in liens can guide you, provide access to auctions, and help with research and strategy. This method is especially beneficial for beginners.

Join Real Estate Investment Groups

These investment groups pool money to buy tax liens together. It is also a good way to invest with lower individual risk and share knowledge with others.

So, these are some of the best options you have to start your journey as a tax lien investor. Be consistent and calm, and I am confident that this investment can do great things for your overall portfolio.

Is Tax Lien Investing a Good Idea for You?

It can be profitable for sure, but whether it is right for you depends on your goals, risk tolerance, and the time you can commit. Let me make it simple for you and start with the quick pros and cons of tax lien investing:

| Pros | Cons |

| Interest rates are often higher than other conventional investments. | Complex rules can add friction for some people. |

| Low entry costs. | Returns may take months or years. |

| Unlike stocks, liens are backed by real estate. If you go unpaid, you could even get ownership. | High competition for popular properties. |

| It adds balance to your investment portfolio. | Legal fees, title checks, and foreclosure costs can reduce your earnings. |

So, it is important to analyse these pros and cons carefully and ask yourself if you are comfortable with what it offers. The bottom line is that it can be rewarding for the patient and informed investors. But if you prefer fast and predictable income, or want to avoid legal complications, it may not be the right choice for you.

Also Read: What is Additional Paid in Capital? — Its Definition, Calculation, and Importance

Tips to Maximize Your Returns on Tax Lien Investment

Before you start to invest in tax liens, here are some of the best tips and guidelines you should follow to maximize your returns:

- Understand the basics of tax liens and how auctions operate. Knowing the legal rules, interest rates, and procedures will help you avoid common mistakes.

- Focus on a specific city or location. Different areas have different laws, interest rates, and risks, so research carefully before investing.

- Not every property with a tax lien is a good investment. Check the property’s condition, neighbourhood, value, and other potential factors.

- Set a budget, decide your maximum bid before the auction, and stick to it. Avoid emotional or ego bidding, as overpaying can reduce your returns.

- After buying a tax lien, you must legally notify the property owner. Follow the rules carefully to avoid any complications.

- Keep a record of deadlines, redemption periods, and expected returns on your investment. Missing a date or any important detail can cost you money.

Apart from this, try to spread your investment across multiple liens and also in other asset classes. And remember, tax lien investing requires patience, as returns often take time but can grow steadily.

Also Read: Tax Accounting: Definition, Types, Importance, Methods, and Effective Steps to Calculate

Tax Lien Investing vs. Tax Deed Investing

Both tax liens and tax deeds allow you to invest through unpaid property taxes, but they work differently. In case of tax liens, you buy the debt on a property. If the homeowner pays it back, you earn interest. And if they don’t, you might end up owning the property. Rules vary by state. Investors often integrate bookkeeping services to track multiple investments effectively.

However, in tax deed investing, you bid on the property itself at an auction. Depending on the state, the owner might have a redemption period to pay taxes, or you could immediately get full ownership.

Tax lien sales happen in 36 states of the United States of America. Tax deed sales are allowed in 31 states (some states allow both). So, in simple terms, tax liens focus on earning interest, and tax deeds focus on acquiring property.

Before you start investing, always research the rules in your area. Your strategy should match your goals, risk tolerance, and patience level.

Final Thoughts

If I have to give my opinion, tax lien investing is a great way to grow your money. It offers steady returns through interest and penalties. However, it has its risks like any other form of investment. So, success depends on understanding the process, doing careful research, and avoiding common mistakes.

I have covered everything you need to start your investment journey. If you want, you can also work with professionals like certified tax lien experts to navigate through this safely and effectively. And if you liked this blog, please share it with your friends and family.

Read Next: 5starsstocks .com Review: Is It the Right Tool for Your Portfolio?

Frequently Asked Questions (FAQs)

Ans: When a property owner fails to pay the due taxes on the property, the government places a lien on your property. The tax lien is the legal claim against your property when you neglect to pay taxes.

Ans: Yes, it can offer higher interest rates than many other conventional instruments of investment. Plus, you can also claim ownership of the property if the owner fails to pay the tax debt.

Ans: Florida, Maryland, Iowa, and Illinois are some of the best states for investing in tax liens. They offer a high interest rate on liens, ranging from 16% to 36%. You should regularly check the official websites to know the updated rates and rules.

Ans: The best way to buy tax liens is by taking part in the official auction. This gives you the chance to get the lien at the best price. If you are a beginner, you can also try to work with a broker or invest as a group.

Sources: