Accounting for Startups: An Entrepreneurial Guide to Maintain Financial Records

As a freshman entrepreneur, you may find managing accounting for startups a daunting task.

Well, regardless of the complexity, accounting and bookkeeping service for startups play a crucial role in analyzing the financial health of a business!!

Without accounting, you won’t be able to track how much money you spend and earn in your business. It not only helps you keep track of your finances but also prevents you from draining your resources.

However, some people find startup bookkeeping stressful and keep on ignoring it.

That’s why I’ve compiled detailed information about startup accounting. So, follow along to learn the nitty-gritty of accounting startups and make your entrepreneurial journey a breeze.

- What is Accounting for Startups?

- How to Start Accounting for Startups?

- Why is Accounting Important for Startups?

- How to Choose Accounting Methods for Startups?

- How to Manage an Accounting System for a New Business?

- Accounting Software for Startups

- Common Types of Business Entities

- What Financial Record Should Every Startup Have?

- Difference between Accounting and Bookkeeping

- Basics of Bookkeeping for Startups

- Final Thoughts

- Frequently Asked Questions

What is Accounting for Startups?

Accounting for startup refers to recording, summarizing, and analyzing financial transactions. It can avoid serious mistakes related to cash inflows and outflows.

In simple terms, accounting is the process of recording all business activities using financial statements. These reports illustrate how operations take place in a company at a specific time.

Hence, you can conclude that startup bookkeeping helps business owners monitor their financial health before finalizing a decision.

How to Start Accounting for Startups?

Starting a new business is a brave decision to take risks and pursue your passion. But many people wonder how to start accounting for startups, as they have no information about it.

Hence, I have mentioned simple steps that are useful in setting up accounting startups. Keep following…!

1. Separate Your Business and Personal Finances

A popular saying describes “business is separate from the owner and vice versa.” That’s why you should open a business bank account to separate your business transactions from your account. This will help you to monitor the business’s income and expenses effortlessly.

2. Set Up Budget

Creating a financial budget allows you to manage your working capital efficiently. While new startups might have limited resources, it is crucial to plan accordingly and reduce unwanted expenditures. It will assist you in making necessary adjustments and focus on key performance indicators (KPI). Thus, the right financial model helps you achieve your goals.

3. Choose an Accounting Method

Are you confused about the method of accounting for startups?

Initially, cash-based accounting is best for small businesses because it is easy to handle. On the other hand, accrual accounting is suitable for large companies that have complex transactions. So, it is recommended to choose your accounting method according to your business entity for better outcomes.

4. List All Charts of Accounts

A chart of accounts (COA) is a list of financial accounts that records your income and expenses. The categories include assets, liabilities, salaries, wages, interest, etc. It is used to record general ledgers, which serve as a roadmap of all business transactions.

5. Understand GAAP

In the US, Generally Accepted Accounting Principles (GAAP) is a set of accounting principles and regulations that a company uses to create financial statements. So, if you also want to start a new business, it is important to understand GAAP and follow its principles.

Here are 10 GAAP core standards that are compulsory to practice in accounting for startups.

- Regularity

- Consistency

- Sincerity

- Permanence of Methods

- Non-Compensation

- Prudence

- Continuity

- Periodicity

- Materiality/Full Disclosure

- Utmost Good Faith

6. Track Income and Expenses

Make sure to record all transactions, whether they range from $1 to $1000. Every single entry is important in accounting for startups to analyze the financial health of a business. You can use accounting software or spreadsheets to record entries daily under their own separate category.

7. Reconcile Bank Statements

Always compare your accounting records and bank statements to ensure accuracy. It is a pro tip to eliminate errors and discrepancies in your financial records. If a gap is found, adjust it accordingly.

8. Prepare Financial Statements

Whether you own a small business or a large business, keeping accounting records is crucial for business survival. Here are three basic financial statements that are necessary to maintain.

- Income Statement: Used to record income and expenses of a business.

- Balance Sheet: It represents assets, liabilities, and equity at a specific time.

- Cash Flow Statement: This shows the real cash inflow and outflow in an organization.

Why is Accounting Important for Startups?

Running a business without maintaining income and expenses is working like a clown. The success of your business relies on your optimal accounting practices, which represent the overall financial image of your business.

Here are the reasons why accounting is crucial for your startup.

1. Support Planning for Growth

For startups, well-maintained accounting records help to analyze your working capital, profits, and losses. This will assist you in making decisions on how to finance cash and expand business.

2. Help in Raising Funds from Investors

If you’re looking to raise funds from a business loan and venture capital, your financial statements are beneficial for you. It will help you impress investors and lenders that your business is profitable and offers them a good return.

3. Keep Track of Your Debts

You can manage and monitor your debts efficiently by keeping accurate financial records. Whether it’s loan payments, credit card payments, or unpaid invoices, accounting shows everything to track your growth patterns.

4. Assist you in Paying Taxes

A professional accounting system helps in achieving tax deduction opportunities like the R&D Tax Credit (Research and Experimentation Tax Credit). It offers additional tax credit incentives for startups engaging in innovation. Plus, you can hire experts to make tax preparations easier for your new business.

5. Adhere to Rules and Regulations

In a new business, audits are more common than you think. That’s why preparing financial statements using the GAAP accounting system is the best way to reduce errors. The principle-based accounting for startups helps you move closer towards your goals.

How to Choose Accounting Methods for Startups?

After determining your business entity, you have to choose a specific accounting method for startups. It is highly recommended to file taxes based on your accounting financial statements for a proper alignment.

Let’s take a look at two primary methods of accounting for startups.

1. Cash Basis Accounting

Cash accounting is a convenient and straightforward method to record transactions based on cash payments. The recognition of income and expenses is recorded when cash is received and paid out.

It primarily focuses on actual cash flow in a business that represents how much cash is in the hands of the owner. Hence, cash accounting is suitable for a sole proprietorship and a small business.

2. Accrual Basis Accounting

Accrual accounting records revenues and expenditures when they happen, instead of fund transfers. It requires invoices and bills while making financial statements to track the current state of assets and liabilities.

Moreover, it provides a more accurate picture of the financial health of a business and is suitable for large companies with complex transactions.

How to Manage an Accounting System for a New Business?

As a business owner in the startup world, your time is as precious as gold. So, you have to decide how to utilize your time in maintaining financial statements. Whether you hire an accountant or do it yourself, always keep in mind that your financial statements are legitimate and transparent.

Let’s take a closer look at how to manage an accounting system for startups.

1. DIY (Do It Yourself)

When you start a new business, there are chances that your budget is too low. So, it is quite expensive to hire an accountant; that’s why you have to prepare financial statements of your own.

However, you’ve got nothing to worry about. In the early days, transactions are limited and simple to record in the accounting system, so you will do it effortlessly. It will boost your confidence in regulating business.

2. Outsourcing

If you are out of the accounting loop, you must outsource an accountant to maintain your bookkeeping. An accountant can help you set up the system and update income and expenses by regularly tracking your finances.

Furthermore, you can manage bookkeeping, tax compliance, and other core principles by hiring an experienced accounting expert. This will help you to bring professionalism to your accounting for startups.

In essence, you can hire or DIY accounting startups according to your preferences and budget. It will make things simpler to keep an eye on how much you earn or spend in a business.

Also Read: Corporate Accounting: Definition, Importance, Types, and Career Potential in 2025

Accounting Software for Startups

As time passed, advanced technology also revolutionized accounting and terminated the use of traditional pen and paper. Now, there are various accounting apps for startups to facilitate financial management.

Here are some popular software programs to reduce human errors efficiently.

1. QuickBooks Online

It is a widely recognized, user-friendly software that integrates with many other business systems. This software offers accounting and bookkeeping services for startups suitable for various industry types.

2. Xero

Xero is popular for its intuitive and modern interface. It is a cloud-based software that provides collaboration features. This software is best for small and medium-sized businesses.

3. Zoho Books

Zoho Books is another budget-friendly accounting software for startups. It offers comprehensive startup accounting features and integration capabilities for small businesses with limited resources.

4. FreshBooks

An intuitive software that focuses on simplicity and time-saving features. FreshBooks is mainly used by freelancers and service-based startups to maintain invoices and track expenses.

5. Wave

Wave is a free accounting software that provides essential features for entrepreneurs who have a tight budget. It’s an impressive software for startups to manage accounting records without spending money.

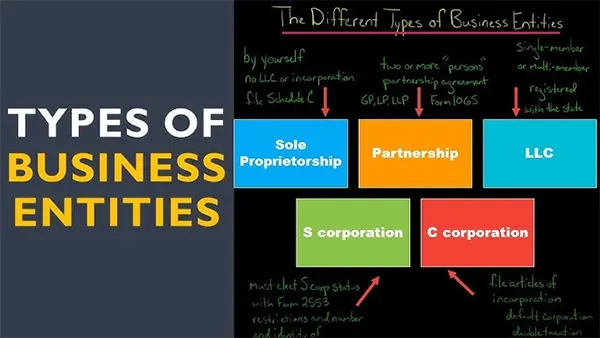

Common Types of Business Entities

Your business entity decides your liability protection, tax structure, and future growth plans. So, choosing a type of business is also a key factor in accounting for startups.

Here, I’ve jotted down some common business entities.

1. Sole Proprietorship

A business owned and run by a single person. It is a small business structure operating from homes or small offices. However, when you run a sole proprietorship, you are liable for all debts and obligations.

2. Partnership

When two or more people get into the same business with one another, it is called a partnership. It is a general agreement that all partners have equal shares of liability, profits, and losses.

3. Limited Liability Company (LLC)

It is a registered form of organization that combines liability protection. In this case, the owner’s personal assets are protected from business liabilities and debts. Comparatively, LLCs are more complex to set up than sole proprietorships and partnerships.

4. C Corporation

A C Corporation is owned by shareholders, who elect a board of directors to manage business operations. In this type of company, taxes are paid separately by the firm instead of the shareholders.

5. S Corporation

An S Corporation has a pass-through taxation structure, meaning that taxes are directly passed to shareholders. Afterward, they submit taxes as personal income tax, avoiding combined corporate tax.

6. Non-Profit Organization

An NPO is an entity that can be run for social welfare, such as educational institutes, charities, and religious communities. The aim is to build a better society for individuals rather than earn profits and reinvest money for a social mission.

What Financial Record Should Every Startup Have?

Start-ups should record everything in financial statements to maintain transparency. You have to be careful not to miss even a single entry of business operations. Recording every transaction will be helpful to analyze how the business works.

Here are some examples of transactions that should be tracked in accounting.

- Bank and credit card statements

- Bills

- Receipts

- Invoices

- Tax Forms

- Payroll records

- Assets

- Liabilities

- Sales and Investments

- Rent, Salaries, and Supplies

Further Read: Accounts Payable vs Accounts Receivable: Understanding Its Features and Differences

Difference Between Accounting and Bookkeeping

Although everyone considers accounting and bookkeeping the same, in reality, they are a bit different. Bookkeeping focuses on recording financial transactions, while accounting is the process of analyzing, interpreting, and using data to make informed decisions.

That’s why I’ve written a detailed breakdown to clear your confusion. Let’s take a look!

| Basis | Accounting | Bookkeeping |

| Focus | Analyzing, interpreting, and summarizing financial data. | Recording all financial records of an organization |

| Tasks | Preparing financial statements and analyzing performance. | Maintaining ledgers and income and expenses entries. |

| Goal | Make financial decisions that comply with regulations to help the business’s financial condition. | Provide accurate and systematic records of business financial activity. |

| Level of Analysis | More analytical on providing insights about financial statements. | Focused more on data entry and organizational records. |

Basics of Bookkeeping for Startups

In a small business or startup, workloads might be overwhelming and frustrating. However, understanding the significant basics of bookkeeping will help you to maintain accurate financial records.

Additionally, the structured method of bookkeeping records the cash inflows and outflows during a particular period. This will be beneficial for you in monitoring revenue and expenses, tax credits, and other factors. Hence, bookkeeping is essential for startups and large businesses as well.

Here are a few bookkeeping basics that will ensure a proper financial statement.

1. Analyzing Business Transactions

Bookkeeping helps you to record all cash payable and receivable entries in specific financial accounts. For example, if you pay for expenses, it is maintained as cash outflow, and all sales income is recorded as cash inflow in the Profit and Loss (P&L) account.

2. Writing Journal Entries

Journal entries are crucial for businesses as they are the foundation of accounting. They are usually recorded daily in a chronological manner, ensuring every transaction is documented. Ultimately, these entries are used to create ledgers and other financial accounts.

3. Keeping Invoices

If you’re planning to start a business, you’ll need an invoice to collect and track money. It is a formal and registered document sent to a customer requesting payment for sold goods and services. This will save you time and money and get you paid faster.

4. Ledger Accounts

Accounting for startups also includes ledger accounts, a summarized form of journal entries. In simple terms, identical entries are recorded in the same accounts. It is used to prepare accurate financial statements like income statements, balance sheets, and cash flow statements.

5. Trial Balance

To double-check the credit and debit balance of ledger accounts, a trial balance is prepared. Additionally, it is used to ensure that journal entries have been recorded safely and accurately. If the balance does not match, it means there is some problem in the financial records.

6. Compare Bank Statements

One of the most essential accounting tips for startups is to compare your bank statements with the company’s accounting records. Whether it is weekly, monthly, or quarterly, you must cross-check your financial statements. If you find any errors, adjust the entries accordingly to match the banking statements.

7. Tax Returns

An accurate bookkeeping allows you to maintain tax returns in accounting for startups. You can easily monitor these records throughout the year by managing an efficient accounting system.

8. Closing Accounts

At the end of the accounting year, closing accounts are prepared to monitor profit and losses. It eventually shows how much a company spends and earns at a specific time. Therefore, good bookkeeping provides detailed and timely records that assist in decision-making.

Final Thoughts

Preparing accounting for startups is important for every business owner. It plays a vital role in summarizing, recording, and analyzing the financial transactions of a business. Making an accurate and clear financial statement of your business takes you to another level of success.

Essentially, you must familiarize yourself with the basics of accounting to monitor the cash inflow and outflow in your company. Furthermore, you can also opt for various accounting software for startups to manage your financial records professionally and easily.

Read Next: Master Cost Accounting: Its Functions, Formulas, and Limitations

Frequently Asked Questions

Ans: The answer is entirely dependent on the criteria of the business. If you manage it on your own, it saves you money. Otherwise, hiring an accountant is a must for startups to record financial transactions.

Ans: Choosing authentic accounting software can help you save money and time. You can try Wave software for free services for your startup.

Ans: There are 6 business entities to start a business.

- Sole Proprietorship

- Partnership

- Limited Liability Company

- C Corporation

- S Corporation

- Nonprofit Organization

Ans: No, accounting is essential to keep records of all income and expenses. Without accounting, you never know about your profits and losses, and your business may face bankruptcy.