Accounts Payable vs Accounts Receivable: Understanding Its Features and Differences

Every business’s foundation lies in financial management. Without proper financial planning—and even with efficient bookkeeping services integrated—even a million-dollar enterprise can go into huge debt. Accounts payable vs accounts receivable are two main components.

Accounts payable (AP) is basically the money you owe to your vendors and suppliers, and Accounts receivable (AR) is the money your customers pay you for their service. Using these gives your corporate accounting a seamless process.

Let’s study accounts payable vs receivable in detail, including features, differences, and uses in this blog. Read it till the end for a better understanding.

- Accounts Payable vs Accounts Receivable

- What is Accounts Payable?

- Example of Accounts Payable

- What is Accounts Receivable?

- Example of Accounts Receivable

- How do Companies Manage Accounts Receivable and Accounts Payable Effectively?

- Why Do Accounts Payable vs Accounts Receivable Matter?

- Wrapping Up

- Frequently Asked Questions

Accounts Payable vs Accounts Receivable

Accounts receivable and payable are completely different terms, yet they are sometimes mistaken for each other. We’ve prepared a detailed comparison table of the two to understand their differences well. Refer to it to clear your doubts. Here is an insight of accounts receivable vs accounts payable.

| Features | Accounts Payable | Accounts Receivable |

| Definition | The amount you need to pay to vendors. | The amount you receive from the customers. |

| Account Type | It is a liability. | It is an asset. |

| Cash Flow | Cash outflow. | Inflow of cash. |

| Record | Balance Sheet (Liabilities column) | Balance Sheet (Asset column) |

| Business Impact | The company or business is the debtor | The company or business is the creditor. |

| Effectiveness on Increase | It increases liabilities. | It increases assets. |

Also Read: Outsourced Accounting: A Way to Delegate the Accounting Burden

What is Accounts Payable?

Accounts Payable works for all sizes of businesses. It is the amount that your business has to pay to its vendor, supplier, or manufacturer for the goods or raw materials you procure. AP account highlights the short-term liabilities the company has to settle within a particular time. The time frame of paying varies and is dependent on the mutual agreement of both the parties.

Key Features of Accounts Payable

These are the key features of accounts payable from the accounts payable vs receivable debate:

- Liabilities: Accounts payable signify short-term debts that a business needs to clear within a designated time frame.

- Credit Acquisitions: Companies utilize AP when obtaining products or services on credit arrangements.

- Listed on the Balance Sheet: Accounts Payable appears in the liabilities section of the company’s balance sheet.

- Affects Cash Flow: Higher accounts payable results in greater liabilities, influencing a company’s cash flow management.

- Demands Prompt Payment: Not settling accounts payable punctually could result in late charges, strained vendor relationships, and supply chain disruptions

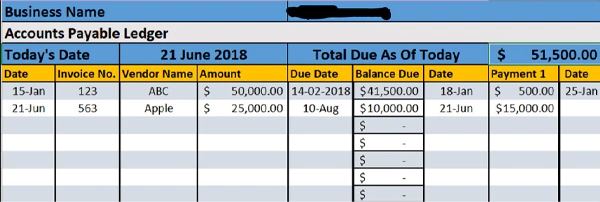

Example of Accounts Payable

Accounts Payable is mentioned in the company accounting or record of every month. Let’s suppose you run a clothing outlet and work with multiple manufacturers to source the raw material or clothing item and for the month of March, your total payable amount is $20,000, which needs to be cleared in 40–60 days. So till the time you pay this bill, it will be written in the Accounts Payable column in your balance sheet.

What is Accounts Receivable?

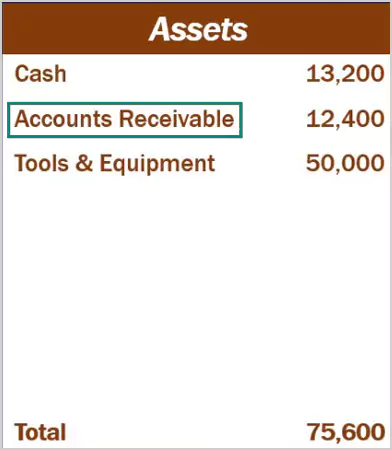

Accounts Receivable is the money the company or business receives into their bank accounts or cash by the customers for the services or goods they sell. This addition of capital is classified as short-term assets. This sum of money is also considered as the company’s revenue after cutting down all the expenses.

Key Features of Accounts Receivable

These are the key features of accounts receivable from the accounts receivable vs accounts payable debate:

- Asset: AR is classified as a company asset as it signifies incoming earnings.

- Credit Transactions: These take place when a business sells products or services under credit conditions.

- Shown in Balance Sheet: AR is listed in the assets category of the balance sheet.

- Cash Inflow: Accounts Receivable add to a business’s income and cash flow upon receipt.

- Needs Follow-Up: Delayed payments or uncollectible debts can affect cash flow and financial health

Further Read: Master Cost Accounting: Its Functions, Formulas, and Limitations

Example of Accounts Receivable

Just like Accounts Payable, the accounts receivable are also reflected on the company’s financial record. Let’s say you run a software company that provides tech solutions to individuals and businesses, and you charge $5000 for the service. Until the time your client pays the money, be it 30 days or 90 days, this amount will be written in the accounts receivable column of the balance sheet.

Moving ahead, let’s now understand how the company can manage AR and AP effectively to be financially sound.

How do Companies Manage Accounts Receivable and Accounts Payable Effectively?

Keeping track of accounts payable vs receivable is crucial, so the company doesn’t go on increasing the debt or losing the asset.

Here’s how companies can manage Accounts Payable:

- Negotiate Beneficial Conditions: Make sure payment terms are in harmony with your cash flow cycle.

- Streamlined AP Process: Utilize accounting software to monitor and handle outstanding payments effectively.

- Foster Positive Vendor Relationships: Prompt payments establish trust and enable improved credit conditions.

- Establish Routine Checkups: Keep track of pending obligations to prevent late payments and fines.

- Track Discounts: Utilize early payment discounts to lower total expenses

Here’s how companies can manage Accounts Receivable:

- Set Precise Credit Policies: Outline payment conditions and make certain customers are aware of them prior to transactions.

- Quick and Precise Billing: Dispatch invoices right after service completion to prevent delays in payment.

- Payment Reminders: Frequently prompt customers about outstanding payments to reduce overdue receivables.

- Provide Various Payment Choices: Diverse payment options promote timely payments.

- Track Aging Reports: Monitor late payments to avoid revenue decline and apply recovery methods

Why do Accounts Payable vs Accounts Receivable Matter?

Both accounts payable vs receivable matters equally because when overlooked it can lead to late fees, cash shortages, damaged relationships with the vendors and suppliers, and even huge loss. Thus, taking note of these helps in maintaining a healthy cash flow within the company or the business.

If you fail to manage AP, you’ll have to deal with late fees and issues with the supply chain. If your AR record is disturbed, you won’t have an inflow of cash and will struggle to cover the operational charges of the business, which can lead to financial distress. A solid cash flow statement is often essential for monitoring these critical aspects.

Wrapping Up

So this was all about Accounts Payable vs Accounts receivable. As we have explained all its key features, managing tips, and examples, we hope this blog has helped you gain a proper understanding of these terms.

So if you are a business owner, remember to keep track of accounts receivable and payable properly to have a healthy cash flow and clear financial record. Year-end accounts services can also help ensure your books are in order.

Read Next: What is Retro Pay? Meaning, Examples, and How it Works

Frequently Asked Questions

Ans: When a company gets money from customers, it’s written in accounts receivable. When the company has to pay vendors to procure raw goods, it’s written in accounts payable.

Ans: This is recorded in the current asset class section in the balance sheet of the company.

Ans: A company must take proper invoices and statements from the vendors to keep track of the cash outflow.