Breaking Down the Ashcroft Capital Lawsuit: Allegations, Responses & Possible Impact

Curious to know what’s going on with the Ashcroft Capital lawsuit? Well, you’re not the only one. This legal case has sparked widespread interest among many investors, financial experts, and people throughout the world.

From serious allegations to strong official responses, this legal dispute becomes a great example that illustrates how real estate companies operate behind the scenes.

Therefore, in this article, we have broken down everything about this case in simple terms. So, whether you’re an investor or just an interested one in finance news, here’s what you might need to know.

- What is the Overall Background of the Ashcroft Capital Lawsuit?

- Simple Breakdown of the Ashcroft Capital Key Allegations

- What are the Ashcroft Capital Lawsuit Payout Considerations and Legal Outcomes?

- What is the Investors’ Reaction After the Ashcroft Capital Lawsuit?

- What is the Official Response Given in the Ashcroft Capital Lawsuit?

- What is the Latest Ashcroft Capital News About its Lawsuit?

- What is the Possible Impact of the Ashcroft Capital Lawsuit on the Real Estate Investing Industry?

- Bottom Line

- Frequently Asked Questions

What is the Overall Background of the Ashcroft Capital Lawsuit?

Ashcroft Capital is a Texas-based real estate investment company, co-founded by Frank Roessler and Joe Fairless in 2015. It is primarily specialized in the Sun Belt multifamily properties and offers expertise in construction, asset, and property management.

Additionally, the firm is widely recognized for its comprehensive real estate investing and apartment syndications.

However, since early 2023, Ashcroft Capital has found itself at the center of the legal controversies that have immensely reshaped the investor’s trust across the private real estate sector.

Accordingly, the Ashcroft Capital Lawsuit has faced several serious allegations, including breach of fiduciary duty, financial misrepresentation, and a lack of transparency.

Consequently, this legal proceeding has sparked concern among financial communities, limited partners (LPs), analysts, and also to those who have seen this company as a profitable investment.

Furthermore, the plaintiff has stated in the court of law that they were intentionally misled about the projected return on investment deals. Because of this, they have to face a lot of unexpected revenue losses.

Lastly, along with numerous law proceedings, the company’s $18 million in investor capital is at stake. Thus, it will not only affect the firm but also the real estate investors and the entire ecosystem of syndicates.

Simple Breakdown of the Ashcroft Capital Key Allegations

The Ashcroft Capital Lawsuit was officially filed on February 12, 2025, under the case title Cautero v. Ashcroft Legacy Funds.

Moreover, the plaintiff of this case includes a group of 12 accredited investors led by Anthony Cautero, who have funded a massive amount for the syndication projects conducted by the Ashcroft Capital firm.

Collectively, the plaintiff has alleged several key allegations with over $18 million in damages against this Texas-based real estate investment firm. This may include:

- Misrepresentation of Return on Investment: The plaintiff states that the company earlier had shown an over-optimistic projection about potential return, which did not match the actual outcome.

- Did not Disclose Material Financial Risks Properly: The investor mentioned that Ashcroft Capital does not disclose the risk accurately at the initial stage, because of which they were not fully prepared for the financial challenges.

- Lack of Transparency and Communication: The petitioners claim that the company did not provide them with the proper financial report on time and intentionally avoided any discussion on this. As a consequence, investors think they were deceived about their money status.

- Inappropriate Use of Investments: The complainant also points out that their money was used for other purposes that were not mentioned on the proposal papers, such as asset improvement and operational costs. Also, the firm did this without their approval or informing them.

- Breach of Fiduciary Duty: Lastly, plaintiff alleges that the firm is misusing the stakeholder funds for their benefit and putting their interest ahead at the time of the conduct. This may include early sales of properties or refinancing the estate with high fees.

Additionally, as of now, this legal proceeding is at the discovery stage. Where both parties are gathering reliable documentation, witnesses for testimonials, and previous financial records.

Thus, the Ashcroft Capital firm’s legal team is trying for a partial dismissal; on the other hand, the plaintiffs are demanding the past financial records and other documents for more clarity.

Also Read: What is Tax Liability? Explore Popular Tips to Minimize Your Tax Liabilities

What are the Ashcroft Capital Lawsuit Payout Considerations and Legal Outcomes?

After the long, heated argument, this suit has centered on one question that every investor has: “Will we get our money back?”. However, as of July 2025, there is no Ashcroft Capital Lawsuit payout has been announced by the court of law.

But still, several legal paths exist, and each of them has its implications for the Ashcroft Capital, the plaintiff (a group of 12 investors), and the prospects of real estate syndication.

Let’s explore these further legal approaches individually in the sections below:

1. Settlement Before the Trial (Most Commonly Used)

In many disputes like this, the plaintiff and defendant resolve their proceeding outside the courtroom by agreeing upon mutual terms and signing a confidential settlement agreement.

The key characteristics of this sort of legal proceeding are:

- There will be no public admission of any wrongdoing by the defendant.

- The firm has to agree on the negotiated amount as compensation for the plaintiff’s loss.

- Both parties may include terms like a Gag Clause and NDAs for better settlement.

- Petitioner may receive partial reimbursement.

Therefore, using this method for the settlement of this case may help to recover some LP funds and eventually safeguard Ashcroft Capital from public humiliation and reputation damage.

2. Plaintiff Wins the Courtroom Trial (Bigger Potential Payout)

Winning in a trial method is not commonly used, but if the complainant manages to prove their accusation against the defendant successfully, the court may reward them with several things.

This may incorporate compensatory damage, punitive damages, court-ordered fee reimbursement, and announced restrictions on future fundraising transactions.

Consequently, the limited partners will be able to acquire a higher percentage of their investment losses. Whereas, Ashcroft Capital may be strictly prohibited from certain investment activities.

3. Defendant Wins the Courtroom Trial (Case Dismissed)

If the court found that the prosecution is not valid, or the plaintiff fails to present reliable documents or witnesses to support their allegation, the case will be dismissed. Also, there will be no such Ashcroft Capital lawsuit payout required.

Moreover, to win this legal proceeding, Ashcroft Capital’s defense can state various arguments, such as:

- The presented internal rate of investment at the initial stage was an estimate, not guaranteed.

- The potential damage risks were accurately mentioned in the offering documents.

- Underperformance was caused by a downfall in the market; no misconduct occurred.

After this, the plaintiffs may lose the invested funds and be left with no recovery amount. Conversely, Ashcroft Capital can continue with its business, though reputational damage may recover over time.

4. Class Action Formation (Only if More Limited Partners Join)

If more investors come forward during the proceedings, the case will be filed under a class action. This can turn into a beneficial opportunity for the complainants.

For instance, plaintiffs can ask for broader fund claims, a consolidated payment, and increase pressure for the quick settlement of the case with complete recovery.

Accordingly, the petitioner may get the comprehensive coverage of their losses, and the firm might have been forced to restructure operations. But remember, in the group action recovery, all 12 plaintiffs may not benefit.

In essence, the only way the Ashcroft Capital Lawsuit payout can be cancelled is if the firm provides all the reliable and accurate documentation with supportive testimonials to the court.

But if any payout or considerations occurred, remember, the settlements take a month to be completed, depending on fund availability, legal verification, and administrative processes.

Suggested Read: Are HOA Fees Tax Deductible? – Ultimate Guide to HOA Dues and Tax Benefits

What is the Investors’ Reaction After the Ashcroft Capital Lawsuit?

Not only in the courtroom, this administrative battle has become the subject of debate, speculation, and concern throughout the real estate fundraising community.

From Facebook groups to public discussion forums like Reddit, Wall Street Oasis, and BiggerPockets, investors and past LPs are raising questions about Ashcroft Capital’s credibility, transparency, and work ethics.

Let’s examine the segment below to learn more about the investors’ reaction that might immensely affect the firm’s reputation.

1. Concern Over Transparency and Lack of Communication

Many investors and limited partners are in shock because of this suit. However, not necessarily in terms of the allegation the company is facing, but more about why they did not get enough warning in the beginning.

Also, on platforms like Reddit and the LPs community, numerous questions are coming up, such as:

- “Why didn’t Ashcroft disclose the damage risk earlier?”

- “Is someone still waiting on the financial reports from Q4, 2026?”

- “I have never received any calls from the firm, and now, suddenly, distribution has stopped? Why?”

Therefore, this extent of questions doesn’t end here; countless queries have been posted almost every day, showing people’s concern and struggle because of the Ashcroft Capital news.

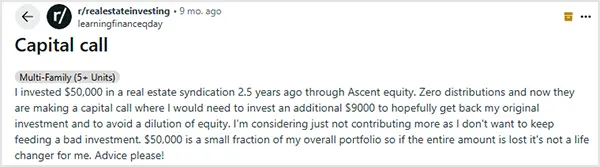

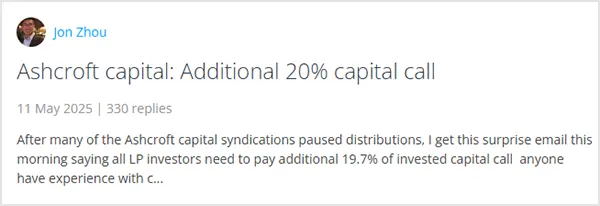

2. Frustration Around Paused Distribution and Capital Calls

There are various forum threads filled with the former and current investors’ comments, where they said that the continuous capital calls even after the cash flow distribution has stopped.

For instance, posts like “They asked for more capital after underperforming for four quarters straight” and “Ashcroft kept charging asset management fees while we got nothing” are coming from various accounts.

Accordingly, statements like this on the outlets are showing the core of the Ashcroft Capital Lawsuit allegations, where plaintiffs claim that the firm is prioritizing the fee collection over fiduciary duties.

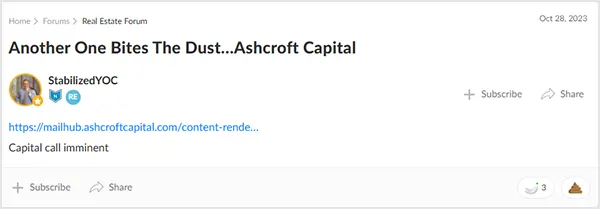

3. Real Estate Investing Community Discussion and Forum Activity

After this heated news gained public attention on a vast scale, people are actively participating in the various communities and forum platforms and showing their anger towards the company.

Moving further, below, we have illustrated some trending images of the possible investor comments from the different platforms. Take a look.

- Wall Street Oasis (WSO): A post titled, “Another One Bites The Dust…Ashcroft Capital, showing frustration because of the firm’s legal suit.

- Reddit: On this forum, one of the users shares his concern about being suddenly paused on distribution, even after completing the fee payment several times.

- BiggerPockets: Last, but not least, on this medium, here is a comment from a user presenting the significance of another allegation against the company. That is adding fees while distribution has been stopped.

In a nutshell, this ongoing legal dispute serves as a wake-up call for all those who have invested in the real sector marketplace or are soon going to be a part of it.

Read More: Is Accounts Receivable an Asset or Liability? Here’s the Detailed Answer

What is the Official Response Given in the Ashcroft Capital Lawsuit?

Responding to the accusing party, Ashcroft Capital had denied all the allegations and strongly stood against every cross-questioning that came forward in the case of Cautero v. Ashcroft Legacy Funds.

Likewise, soon after this case became public in March 2025, the CEO Joe Fairless released an official press statement, in which he firmly denied all the allegations.

Also, he assures everyone about their commitments to ethical investing, transparency, and long-term values.

Moreover, the CEO addressed the situation directly in an email to their limited partners, mentioning the company’s credible track record, high-quality real estate investments, and dedication to open communication.

Therefore, these quick responses from the firms are intended to eliminate any concern raised among existing or possible investors and safeguard their reputation from false rumors.

What is the Latest Ashcroft Capital News About its Lawsuit?

As of July 2025, the Ashcroft Capital lawsuit is in the discovery phase, and the litigation is still pending.

Moreover, according to the official sources, both parties are preparing the case with reliable documentation and witnesses to represent in court. Simply because settlement negotiation is still ongoing and mutual agreements haven’t still finalized.

Thus, explore the pointer below to know what is the current situation in the courtroom.

- Plaintiff’s Argument: The complainant’s lawyer submits various evidence against the firms, such as emails, the company’s previous documents, and testimony of the former employees. Accordingly, the presented documents show how Ashcroft deceived the sales and hid the risk at the time of the agreement.

- Firm’s Response: Ashcroft Capital confidently denies all the allegations in the court. They state that the due diligence documents, such as Private Placement Memos (PPMs), were already given to the LPs by the SEC guidelines.

Overall, the arguments and presentation of the documents are continuing in the court. Both parties are strongly standing by their clauses and fighting to acquire the upper hand. Thus, it seems the final verdict or any kind of negotiation is not happening soon.

What is the Possible Impact of the Ashcroft Capital Lawsuit on the Real Estate Investing Industry?

The ripple effects of this legal proceeding are not limited to any one company or its plaintiff (a group of 12 investors).

This case has quickly become a warning for real estate syndication, raising several serious questions like investor protection, authentic business ethics, and maintaining transparency.

Check out the pointers below to learn more about the potential implications the real estate sector may have for adoption.

- Enhanced Scrutiny: Nowadays, investors are looking for comprehensive regulations of real estate syndications to be certain about the terms and risks at the start.

- Maintain Clear Communication: After the Ashcroft case sparked, stakeholders are more likely to invest in the firms that prioritize regular meetings and provide accurate financial reports on time.

- Change Syndication Procedure: From now onwards, real estate investing sectors are modifying their existing syndication process, ensuring clearer IRR rate and distribution system to their investors.

All in all, after the Ashcroft Capital lawsuit, the entire real estate sector, investors, and analysts have become more cautious about the terms and clauses mentioned in the proposal letters.

Moreover, many companies have started implementing the crucial measures to be clear and precise with the limited partner. Also, they now make an effort to explain the IRR and potential risks from the very beginning, aiming to avoid any sort of misunderstanding in the future.

Bottom Line

In the end, the Ashcroft Capital Lawsuit reminds us all how fast things can change in the business world. While the final verdict from the court of law is still uncertain, this legal proceeding has become a strong reminder of why transparency and trust matter the most.

Moreover, stories like this aren’t just trending headlines; they can shape the entire process of how one views the surrounding companies.

Therefore, the Ashcroft Capital lawsuit is not centered around who wins or loses; it’s about learning from what went wrong and bringing this real estate firm to this extent.

Because sometimes knowing the entire story assists you in making more informed decisions in the future.

Next Read: Corporate Accounting: Definition, Importance, Types, and Career Potential in 2025

Frequently Asked Questions

Ans: The group of 12 accentors investors led by the plaintiff, Anthony Cautero, has filed the legal proceeding against this Texas-based real estate investing company.

Ans: Yes, the interested one can still start funding with this company. But before any final decision, ensure to verify every document and clause attentively to avoid any sort of sudden loss.

Ans: You can follow the recent court filings at the U.S. District Court of New Jersey and financial news platforms. Also, if you are interested in the real-time discussion, join forums like Reddit, BiggerPockets, and Wall Street Oasis (WSO).

Ans: During the court proceedings, plaintiffs have mentioned that the firm has suddenly paused the cash flow distribution without informing or communicating first. Also, it starts making calls for the additional fee collection.

Ans: This means the firm is asking investors to contribute additional fee for their invested projects.