15 Common Cash App Scams: Learn How to Avoid Scams in 2025

Cash App has made sending and receiving money online effortless, just with one click. Due to its cutting-edge technology, it has become a household name for safely transferring money into another account. Whether you want to pay college fees or buy products, Cash App makes transactions like a piece of cake.In fact, for small businesses and freelancers, using Cash App alongside proper accounting for startups can streamline both payments and recordkeeping

However, this convenience also attracts scammers. They are defrauding people to steal their identities for some wrongdoing. So, if you use this app, you should be aware of these Cash App scams.

Hence, to keep our readers off these scammers, we’ve provided some common Cash App scams that have emerged recently. So, examine the details closely till the end.

Common 15 Cash App Scams You Must Know

Scams can happen to anyone. The majority of tricksters are canny to exploit you in their traps and steal your confidential information. Luckily, many Cash App scams can be avoided when you know what types of scams are common in the banking industry.

Here’s a look at the frequent frauds to take precautions in the future.

1. Catfishing Scams

One of the most common online scams is getting trapped in romantic relationships. Scammers use fake identities to make connections online and ask you to send money via a Cash App. Their promises and fake convincing stories are only a part of a scam to extort money from you.

Not only this, they win your trust as time passes and collect your personal information. It includes your name, age, address, financial data, account details, UTR number, as well as passwords. That’s why you should be careful about making friends through social media and dating apps.

2. Accidental Cash Transfers

Has money been mistakenly deposited in your account?

Then, a stranger sends you a message to return the payment, along with an extra transaction fee.This scam often leaves users confused, especially those managing small business transactions without bookkeeping services.

Sounds relatable!?

Well, this is another type of scam. In this fraudulent practice, tricksters aim to steal your card and account details for illegal use. So, never return money or transactional charges to strangers, especially if they are not from the Cash App.

Furthermore, in case you genuinely want to return the cash, either use the “refund” option within the app or meet in person. This will help you protect yourself from Cash App scams.

3. Investment Scams

The “get-rich-quick” schemes are another Cash App scam that frequently attracts innocent people. A fraudster pretending to be an investor or financial expert may contact people to invest in exclusive return opportunities. Instead, opt for legitimate platforms and perhaps consider secure routes like using cash flow management service or consulting professional advisors.

Plus, they create a situation of urgency to easily convince individuals to invest. In order to make more money, they force people to send cash through private channels using the “Cash App”. Afterward, they take off with all the money.

Thus, always opt for legitimate investment platforms and trustworthy advisors. In case of suspicious activity, block tricksters immediately from the Cash App.

4. Money Flip Scams

A “cash flipping scam” is a type of cybercrime where Cash App scammers promise to multiply your money. They will claim to turn your small amount of money into a larger sum with great interest rates in a short period. To keep your funds safe and plan better, it’s wise to track all flows with proper cash flow statement documentation.

With fake testimonials, credentials, and evidence, they influence you to transfer money to test their flipping capability. Once they receive the initial payment, the scammers will block you, disappear with the funds, and leave you nothing.

As per the rule, people who make such false assurances are fraudsters. Therefore, you have to avoid investing in such phishing schemes and be aware of Cash App scams.

5. Survey Cash App Scams

Public surveys are often a part of assessing thoughts, opinions, and other factors about products or services. Have you ever examined how people scam on Cash App using surveys?

Con artists contact you with an email or social media, providing a survey that seems like a legitimate company. They persuade you to enter the survey through the phishing link they created. Afterward, they might ask you for a small amount of payment, adding personal information like a security pin or birthdate.

Once you enter all the details, they will sell your confidential data to third parties or access your bank account. With those consequences in mind, never click on any suspicious links or share your financial details with strangers. If you’re ever tricked into such traps and lose money as part of payroll or incentives, it’s crucial to verify things through robust payroll accounting services.

6. Posing As Cash App Support

The majority of Cash App scammers pretended to be customer care or other employees from the app. They reach out to you via direct calls or messages and demand information like your sign-in code for KYC purposes.

To avoid such frauds, always take note that Cash App support will never ask customers to provide security pins, account balances, debit card numbers, or other private data for remote transactions and testaments.

Generally, if someone requests you for privileged information, it’s a scam. Because of this, the Cash App Contact team recommends reporting such scams directly within the app software. Stay sharp and never hand over sensitive data like your tax identification number or account credentials.

7. Giveaway Fraudulent Scheme

Many social media accounts and small businesses run giveaway alerts for their followers. However, this prompted the rise of fake giveaways under the name of Cash App.

Imposters claim big prizes in partnership with the official app and foster hashtags like #cashappgiveaways or #cashappfridays on social media. They might demand a small amount of processing fee for completing a test transaction. Moreover, they convince you to submit account details for a verification process to collect a fake money prize.

Ignoring these traps, you have to double-check whether it is fake or real. Usually, official giveaways never want you to add personal material for prizes.

8. Fake Refunds

As a business owner, you will frequently encounter fake refund scams. In this case, scammers contact you and show interest in buying a product or service you sell.

Later, they make a payment via the Cash App (a payment that you’ll never receive). Besides this, claiming that they’ll make multiple payments and requests for refunds. Hence, they will demand your own money as a refund for an item that they never paid for.

To prevent fake refunds, ask for verification of contact IDs and screenshots of payments. Also, cross-check the references or documents and impose a strict refund and return policy. Implementing a system backed by year-end accounts services can provide an extra layer of financial clarity and fraud tracking.

9. Apartment or Rental Deposit Scams

Are you looking for a living space for yourself? Then, you might be the next target of scammers. One of the prevalent Cash App scams is depositing advanced money for a house that isn’t available.

In this type of scam, fraudsters create a compelling ad for rental properties to trap someone like you. They pressure you to deposit the first month’s installment before seeing an actual apartment. Once you pay them, they’ll disappear and take off with your money.

For this reason, you must visit the house or apartment before buying or renting it. This will help you to bypass the potential fraud regarding money.

10. Phishing Attempts

These kinds of Cash App scams are regularly seen on Cash App. A dodger creates a fake profile and sends you phony emails and texts. The messages seem likely to be generated automatically by the official app.

In addition, texts include phishing links that aim to access your debit card number or security PIN. By accessing all your information, scammers commit fraud, such as hacking and identity theft.

On the contrary, never trust skeptical links and messages. Always download or use Cash App from the official site instead of dubious links.

11. App Glitch

Because of technical issues in digital transactions, swindlers take advantage to execute petty crimes. For instance, they convince you there’s an app glitch in Cash App, so you should download a better version of it through their fake links.

After that, the link redirects you to some shady webpage that might hack your bank account. Moreover, they steal your personal information and misuse your ID proof for wrongdoings.

That’s why, if you notice some doubtful activities, either report it on Cash App or delete your Cash App account. You’ll find valuable information on how to delete a Cash App account here.

12. Pet Deposit Scams

Pet deposit is another type of prevalent Cash App scam where fraudsters maintain a fake profile of selling cute puppies and kittens at a discounted price. If the seller claims to be a business, check their legitimacy through documentation or registered accounting service for startup.

Additionally, they make false statements to influence you. They ask for payment earlier through banking apps or wire transfers to reserve your pet. Once they receive it, they run away with your money, and you never get a pet.

To avoid these types of fraud, always try to meet in person with the seller before making payments. Check their registration as self-employed or business profile; if you find nothing, it’s a scam.

13. Government Relief Frauds

Some imposters may allude to government policy to make more money. They promise cash in the form of government grants or relief programs. This type of Cash App scam is frequent after the COVID-19 pandemic.

In this scam, fraudsters might request you to make initial processing payments to collect big rewards. They can look legitimate because of their convincing skills and entirely persuade you to execute such transactions. But any financial request as a government program is a red flag.

Aside from this, always remember that the ministry policies never ask for upfront payments under whatever conditions. You have to be cautious about your personal information, as prevention is better than a cure.

14. Free Money and Reward Scams

Who doesn’t like free money? Everyone wants to have more money in their bank accounts. Unfortunately, the craving for free money often leads to big scam alerts.

Yes, another teaching scam is mostly seen in banking apps. Scammers request that you transfer a fee to show how their tactics multiply money. They might also promise to deposit free money into your account. Furthermore, they influence you to teach techniques related to earning hefty money without doing anything.

So, if you’re dreaming of getting free money, be careful of such scams. You may lose all your hard-earned money in greed for cash rewards.

15. SSN Scams

Social Security scams primarily aim to exploit your security concerns on Cash App. Some imposters use phony identities to contact you about a stranger who has access to your Social Security Number (SSN).

Moreover, they create an emergency plot to pressure you into believing them. For example, they use the common term: “You’re eligible for a new card or suspicious activity found on your Cash App”.

Alongside, they also demand to transfer funds in the guise of processing payment, protection, and verification. However, you have to be aware of this kind of pretense.

Also Read: Accounts Payable vs Accounts Receivable: Understanding Its Features and Differences

How to Avoid Cash App Scams?

Scammers are sharp-witted, so they can easily manipulate you to access your personal information. However, practicing safety measures can help you to be secure from potential risks and scams. Your safety is in your hands, try to avoid trusting people whom you don’t know.

Other than this, always opt for the below-mentioned points to safeguard your confidential details.

1. Don’t Share Your Details Online

Be careful of what you share online. A fraudster may steal your personal information and sell it to data brokers. Never submit your account details, security PIN, and log-in code to random emails or messages. It’s a scam that would lead to undesirable consequences.

2. Never Exchange Payments With a Random Person

Cash App allows you to transfer larger funds or one-time services personally for a hassle-free transaction. If you execute payments with a random person or a stranger, it might encourage predators to target your bank account. So, always double-check the reliability of another person.

3. Review Your Bank Statement Regularly

Periodically, check your bank account and transactions for any suspicious activity. If you find some data breaches or theft, report it on the Cash App right away. Additionally, update your passwords to protect your bank accounts for secure online transactions.

4. Avoid Suspicious Links

As we described previously, do not click on random links and emails. This may redirect you to a phishing webpage, which steals all your private information. Always trust Cash App messages and avoid focusing on outside texts.

5. Set Up Strong and Unique Passwords

If you use the same and common passwords for multiple accounts, fraudsters can easily access your details. Accordingly, it is recommended to set up a strong and unique security PIN to add an extra layer of protection for your Cash App.

6. Use Two-Factor Authentication

The two-factor authentication (2FA) utilizes biometric and facial recognition technology to secure your banking app. If you set up 2FA, you’ll receive an OTP (One Time Password) before letting you enter the app. This will ensure a safe transaction.

How to Report a Phishing Transaction?

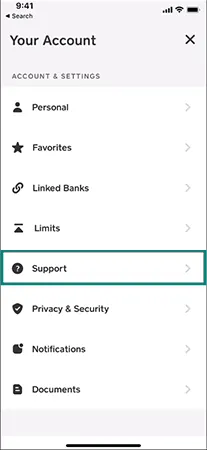

Cash App support delivers a report option within the app to prevent you from phishing attempts and fake transactions. Let’s explore some simple steps on how to report fraudulent payments.

- Step 1: Click on the Profile icon on the Cash App.

- Step 2: Tap “Support”.

- Step 3: Now, click on the “Report an Issue” option.

- Step 4: Select the scam payment.

- Step 5: Follow the prompts provided by the app.

How to Block a Scam Account?

Along with the reporting facility, Cash App also offers a blocking feature to avoid scammers and their fraud. You can quickly block a scam account with just a few clicks.

Take a look at these quick steps:

- Step 1: Open the scam profile in the Cash App.

- Step 2: Also, you can search profiles with name, mobile number, or email address.

- Step 3: Scroll to the bottom of the profile.

- Step 4: Click on “Report or Block”, according to your preferences.

- Step 5: Follow the on-screen prompts given by the app.

Also Read: Outsourced Accounting: A Way to Delegate the Accounting Burden

Wrapping Up!

There are a lot of Cash App scams, but by taking preventive measures and staying vigilant, you can safely use Cash App. Without falling for fake lucrative schemes or free money phishing attempts, you’ll always protect your bank account.

Staying up-to-date and never trusting random people in terms of financial details will also help you avoid scammers. By following secure measures, you can do online transactions without worrying about scams or fraud.

Frequently Asked Questions

Ans: Yes, Cash App is safe to make online transactions as it provides advanced encryption and fraud detection technology to secure your payments.

Ans: This type of scam includes suspicious links that look like automated Cash App messages. A scammer who pretended to be a legitimate employee from a banking company. To protect your account, always follow safety measures to avoid scams.

Ans: Phishing attempts, fake surveys, giveaway scams, and posing as Cash App support are some common scams.

Ans: Yes, accidental payments are a sign of a scam. You can meet in person to refund payments.

Sources: