What is Form 8962? Who Must File It and How to Fill Out Form 8962 (A Complete Guide)

Have you ever repaid your tax refund on the basis of receiving excess APTC, or has your tax return ever been rejected with the cause mentioning “Form 8962 not filed”? If this has happened to you, you must know what Form 8962 is, as ignoring this and not filing taxes can lead to consequences.

The Form 8962 is used to compare the estimated income you provided to the Health Insurance Marketplace with your actual income reported on your tax return for the year.

Before delving more into the topic, you must know some important terms that are commonly used in this context. Let’s take a look at them first.

Key Terms You Must Know Before Starting:

Premium Tax Credit (PTC): It is a refundable tax credit or subsidy that lowers the insurance premium cost for lower and middle-income individuals when they enroll in a health plan through the Health Insurance Marketplace. For a deeper look at how various tax credits and liabilities interplay, you might also want to check out our overview on federal income tax.

Advance Premium Tax Credit (APTC): It is the same as the PTC, but the difference is in the timing of receipt. This part of the credit or subsidy is directly paid by the government to your health insurance each month.

Modified Adjusted Gross Income (MAGI): It is the adjusted gross income of an individual after making all the deductions and tax penalties. If you’re figuring out taxable income or how deductions affect MAGI, our guide on marginal tax rate may be helpful.

Applicable Figure: A percentage that determines the proportion of your income you are expected to contribute to the Health Insurance Marketplace.

Household size: It is the number of people included in your tax return. For example, your spouse and dependents.

- What is Form 8962? (Core Concept)

- Who Must File Form 8962? (Use Cases)

- What Documents Do You Need Before Filing Out Form 8962?

- How to Fill Out Form 8962? (A Complete Breakdown of Form 8962)

- Income Thresholds & Eligibility Rules for PTC and Form 8962

- What Are the Most Common Form 8962 Mistakes and How Can You Avoid Them?

- How Does Form 8962 Affect Refunds?

- Should You File Form 8962 Electronically or on Paper for Best Results?

- Key Takeaways

- FAQs

What is Form 8962? (Core Concept)

Form 8962 is an IRS form that is used to reconcile the premium tax credit (PTC) with the advance premium tax credit (APTC) you received when purchasing health insurance through the marketplace. This form compares the actual income with the estimated income of an individual.

These subsidies are estimated by the marketplace by using your estimated annual income, projected income, or MAGI.

All the reconciliation processed in the 8962 form makes sure that you receive the correct excess repayment.

Note: You only need to file IRS Form 8962 if you received APTC or want to claim PTC. Also see our discussion on what happens if you don’t file taxes properly and potential consequences in What Happens If You Don’t File Taxes.

Also Read: What is Medicare Tax? How Should Employees and Employers Pay Medicare Tax?

Who Must File Form 8962? (Use Cases)

After understanding what Form 8962 is, let’s hop into who needs to file the 8962 Form, along with breaking the surrounding myths.

You Must File If:

- You receive the Advance Premium Tax Credit (APTC).

- You want to claim the Premium Tax Credit (PTC).

You Should Not File If:

- You haven’t enrolled in a health plan through the Health Insurance Marketplace.

- You don’t want a PTC claim or haven’t received any Advance Premium Tax Credit (APTC).

Special Scenarios:

- You don’t need to file a 8962 Form if you separately file taxes from your spouse, as you can’t claim PTC. But if you have experienced spousal abandonment and domestic violence, you can claim PTC and need to file Form 8962.

- If you claim someone as your dependent, you need to file the 8962 Form. For more general context on various taxes, deductions and other tax forms, you may also check Is Alimony Taxable? — sometimes side-incomes and support payments alter your MAGI or filing requirements.

What Documents Do You Need Before Filing Out Form 8962?

You mainly need Form 1095-A, records of your income sources, and complete information

- Form 1095-A: Also known as the Health Insurance Marketplace Statement, it is sent to individuals who are enrolled in health insurance through the insurance marketplace.

- Records of all your income sources [pay stubs, W-2 forms, 1099 forms for all income types, business income records, rental income records, 1099-R, social security benefits statements, and alimony received (if any)]: This includes complete information on all your income sources to calculate your MAGI (Modified Adjusted Gross Income).

- Documents covering the complete information on your income tax return (Form 1040, W-2 forms, 1099 forms, Schedule C, SSA-1099, tax-exempt interest statements, foreign earned income documents, or any documents showing income adjustments): These include your tax return information, mainly MAGI (Modified Adjusted Gross Income), to find out the total household income of the taxpayers to calculate their Premium Tax Credit (PTC). If you also have situations like overtime income, bonuses, or other irregular income, supplemental resources such as No Tax on Overtime may help when calculating final income and taxes owed.

Also Read: What is the 5498 Tax Form? Reporting Information, Common Mistakes, and More

How to Fill Out Form 8962? (A Complete Breakdown of Form 8962)

The IRS Form 8962 is mainly divided into 5 parts, namely Annual and Monthly Contribution Amount, Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit, Repayment of Excess Advance Payment of the Premium Tax Credit, Allocation of Policy Amounts, and Alternative Calculation for Year of Marriage. Each should be filled cautiously with the correct information.

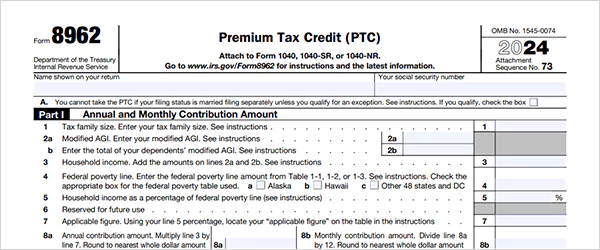

Part I: Annual and Monthly Contribution Amount

The very first step of filling out the Form 8962 is mentioning your name and social security number in their respective sections.

1. Enter your family size in numbers (you, spouse if filing jointly, and dependents).

2a. Mention your Modified Adjusted Gross Income (MAGI).

2b. Mention the combined Modified Adjusted Gross Income (MAGI) of your spouse and dependents.

3. Mention the collective amounts of 2a and 2b.

4. Mention the FPL dollar amount for your family size and select the correct state column.

5. Mention the percentage of your household income to your FPL.

6. No need to fill this line.

7. Write the applicable percentage figure that matches your % of FPL from the IRS table.

8a. Write your annual contribution amount, multiply 3 and 7.

8b. Write your monthly contribution, 8a divided by 7.

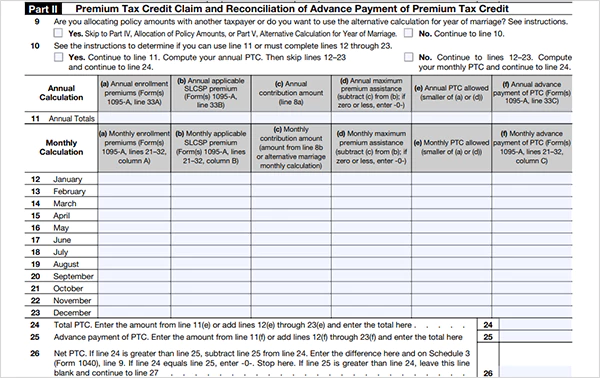

Part II: Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

9. Select “Yes” if you are allocating policy amounts with another taxpayer and directly skip to Part IV and Part V of the 8962 Form. If “No,” continue to the next line.

10. If you want to calculate your annual PTC, select “Yes” and continue with 11. If you want to calculate your monthly PTC, select “No” and continue with 11-23.

24. Mention the total PTC allowed for the year, either from 11(e) or combined from 12(e) to 23(e).

25. Mention the total Advance Premium Tax Credit (APTC) received from line 11(F) or the combined from 12(f) to 23(f).

26. Mention the difference between the total PTC (24) and APTC (25).

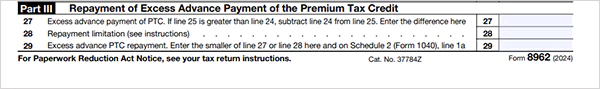

Part III: Repayment of Excess Advance Payment of the Premium Tax Credit

27. If the APTC is greater than the PTC, write the difference here.

28. Go through the instructions and mention how much you need to repay.

29. Mention either the amount of 27 or 28, whichever is less.

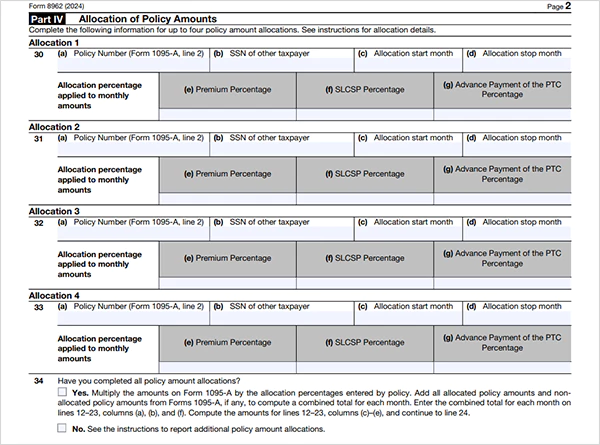

Part IV: Allocation of Policy Amounts

This section shows the allocation of policy amount for up to 4 taxpayers.

30/31/32/33(a). Write the policy numbers as mentioned in the Form 1095-A.

30/31/32/33(b). Write the Social Security Number of the other taxpayers.

30/31/32/33(c). Write the allocation start month in numbers.

30/31/32/33(d). Write the allocation end month in numbers.

30/31/32/33(e). Write the percentage of the premium allocated to the other taxpayer.

30/31/32/33(f). Write the SLCSP percentage that is allocated to other taxpayers.

30/31/32/33(g). Write the ATPC percentage that is allocated to other taxpayers for those months.

34. Select “Yes” if all the allocations are mentioned. “No,” if there are more allocations.

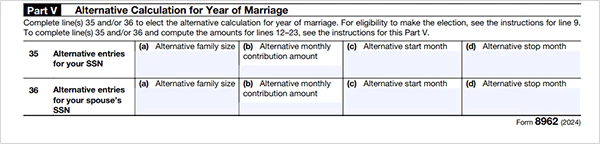

Part V: Alternative Calculation for Year of Marriage

These lines are filled only if you elect the alternative calculation for the year of marriage or separation.

35. Write the (a) alternate family size, (b) alternate monthly contribution amount, (c) alternate start month, and (d) alternate stop month of your Social Security Number.

36. Write the (a) alternate family size, (b) alternate monthly contribution amount, (c) alternate start month, and (d) alternate stop month of your spouse’s Social Security Number.

Income Thresholds & Eligibility Rules for PTC and Form 8962

The eligibility of the Premium Tax Credit and the 8962 Form is the same, as both are interdependent. So, here are the requirements for filling out the IRS Form 8962.

- You must have health insurance through the Health Insurance Marketplace.

- Your household income must fall under the qualifying MAGI range relative to the Federal Poverty Line, which ranges from 100% to 400% FPL, adjusted by household size and state (48 states, Alaska, and Hawaii).

- If someone else lists you as a dependent, you can’t fill out the 8962 Form and claim PTC.

- Married couples must file Form 8962 jointly, not individually.

- Any change in the household must be reported to the marketplace, as it affects the PTC amount.

- If your actual income is higher than the estimated income, the excess APTC must be repaid while filling out the Form 8962.

- The FPL amount depends on where you live. Different FPL levels apply for 48 contiguous states + DC, Alaska, and Hawaii.

Also Read: What is a Schedule E Tax Form? And How to File It?

What Are the Most Common Form 8962 Mistakes and How Can You Avoid Them?

Some common Form 8962 mistakes are not attaching the Form 1095-A, using the wrong SLCSP, inaccurate MAGI calculation, ignoring shared policy rules, and skipping the 8962 Form. Let’s read them in detail.

- Not Attaching the Form 1095-A: The IRS only verifies the Premium Tax Credit (PTC) amount with the Form 1095-A.

- Using the Wrong SLCSP: Use the right SLCSP or updated marketplace data for correct PTC calculations and IRS corrections.

- Incorrect MAGI Calculation: Make sure not to miss any income sources, such as untaxed foreign income, tax-exempt interest, or dependents’ income. It can lead to incorrect MAGI and PTC amounts.

- Ignoring Shared Policy Rules: Must use allocation rules in Part IV of IRS Form 8962 if the policy covers more than one household. For example, divorced parents, dependents, and shared custody.

- Skipping Form 8962: Make sure to fill out the Form 8962 if you received the Advanced Premium Tax Credit (APTC). Not filling it out will lead to your refunds getting on hold until the submission.

How Does Form 8962 Affect Refunds?

The IRS Form 8962 affects the refund in mainly 2 different ways, i.e., the refund increases when PTC is higher than APTC and decreases when APTC is higher than PTC.

Refunds Increase When:

Allowed PTC > APTC received

If the IRS finds out that you are supposed to get more premium tax credit than the amount you received in advance, the difference will be refunded.

Refund Decreases When:

APTC received > Allowed PTC

If you receive a higher refund than what you are supposed to receive, you must repay the excess on your tax return.

Also Read: What is Tax Loss Harvesting? Learn About Its Benefits with a Practical Example

Should You File Form 8962 Electronically or on Paper for Best Results?: Comparison

You should always file the IRS Form 8962 electronically, as it’s a better medium in all aspects. Let’s evaluate this with this comparison table.

| Electronic Filing (E-Filing) | Paper Filling |

| Electronic filing is faster and more reliable. | All the figures must be written manually. |

| There is no need for manual data entry of Form 1095-A, as it often automatically imports into the system. | Chances of error increase with manual entries, leading to processing delays and correction notices. |

| Built-in software checks help to point out the common and complex mistakes, such as SLCSP values or MAGI calculations. | Refunds on paper filing take longer to process, often extending refund timelines. |

| The e-filed IRS Form 8962 is processed faster, resulting in quick refunds. |

Key Takeaways

- The IRS Form 8962 is used to reconcile the premium tax credit (PTC) with the advance premium tax credit (APTC) you received when purchasing health insurance through the marketplace.

- Individuals must file the Form 8962 if they receive the Advanced Premium Tax Credit (APTC) and want to receive the Premium Tax Credit (PTC).

- Most of the taxpayers prefer to file the Form 8962 electronically, as it is a far superior method to the traditional paper filing method.

Also Read: 529 Tax Deduction Plan: What is It, How to Claim, and Maximize the Benefits?

FAQs

Ans: The IRS Form 8962 is used to determine the right amount of premium tax credit during the year. It compares the advance amount you use to the amount you qualify for based on your final income.

Ans: The household income is the combined MAGI of you, your spouse, and any dependents.

Ans: Yes, your tax return can get rejected for not filling out Form 8962. You must file a Form 8962 with your federal income tax return in order to “reconcile” your estimated and actual income for the year.