What is Bookkeeping?—Types, Methods, Needs, Tasks, and How to Become a Bookkeeper

Every year at the end of the financial year, companies release their financial statements to their investors, creditors, and sometimes even the public. But how do you think these reports are made?

It all begins with the first step of the accounting process, i.e., bookkeeping. Many companies, especially those in early stages, rely on tailored accounting service for startup to set up these foundational processes accurately.

So, what is book keeping?

It is part of an accounting process where the bookkeepers record every financial transaction of a company in order. Later, the accountants use these records to prepare financial statements.

If you are interested in learning more about what is book keeping, its types, methods, processes, tasks, and how to become a bookkeeper for a company, simply scroll through the blog!

What is Book Keeping?

Bookkeeping is the process of recording every financial transaction of a company on a daily basis. It is a basic and foundational part of an accounting cycle that is only available to the internal part of a firm.

It involves recording every transaction (purchase, sales, receipts, and payments), operation (finance, inventory, resource, etc.), and events that happen in a business.

All in all, whether the money is going out or coming in, it records every piece of information so the business can maintain a healthy financial condition.

Previously, bookkeeping was limited to papers and pens, but now there are a good number of software programs that help you record every transaction. Many of these programs also allow you to integrate payroll accounting services directly into your financial systems for greater efficiency.

Types of Bookkeeping

Now that you know what is book keeping, let’s get to know its types!

There are mainly two types of bookkeeping systems that are commonly used in many companies. These two include:

Single-Entry Bookkeeping

Single-entry bookkeeping is a simple accounting method where all the transactions are recorded only once. It mainly records the transactions as expenses and income (usually in a cash book) instead of assets and liabilities.

For example, if an organization pays $1000 for inventory and supplies, then it will record the amount as expenses. However, if it receives $100 in sales, then it will be noted in the income section.

Here I’ve compiled two or three entries in the single-entry system to show you how it works!

| Date | Description | Notes | Transaction | Account Balance | |

| Expense (Debit) | Income (Credit) | ||||

| 01/04/2025 | Starting Balance | $5000 | |||

| 02/04/2025 | Rent | $500 | $4500 ($5000 – $500) | ||

| 03/04/2025 | Sales | $1000 | $5500 ($4500 + $1000) | ||

| 04/04/2025 | Supplies | Furniture and Machinery | $2000 | $3500 ($5500 – $2000) | |

| 05/04/2025 | Ending balance | $3500 | |||

However, the thing to note here is that the single-entry system only affects one account, which is why it is the least-used system in companies.

Double-Entry Bookkeeping

So, what is double entry accounting?

It is the most commonly used bookkeeping system, where every transaction is recorded twice (in two accounts). It is very complex compared to the single-entry method, but it is less likely to give errors.

Basically, double-entry bookkeeping affects two accounts, where one is debited and the other is credited.

Suppose you paid $50,000 in cash to purchase machinery for your business. Then, your cash account will be deducted (debited) by $50,000, and the machinery account will be increased (credited) by $50,000.

To understand it better, take a look at the entry in the double-entry bookkeeping system below.

| Particulars | Debit (Dr.) | Credit (Cr.) |

| From Cash A/C Dr. | $50,000 | __ |

| To Machinery A/C | __ | $50,000 |

Also Read: Corporate Accounting: Definition, Importance, Types, and Career Potential in 2025

Process of Bookkeeping

As we already know, bookkeeping means recording the financial transactions of a business. But how is it actually done?

Here I’ve jotted down its whole process in detail, so make sure to take a look!

Identifying and Analyzing Transactions

The first part of bookkeeping is to find all the transactions that took place, including all the sales, purchases, payments (made or received), etc. Then, you would have to check which accounts were actually affected because of transactions.

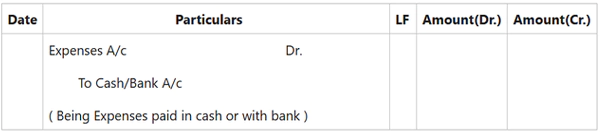

Journal Entries

When you are done analyzing, the next step is to note the transactions in the journal in chronological order, along with the date, description, and debit or credit amounts. Here is an example of a journal entry!

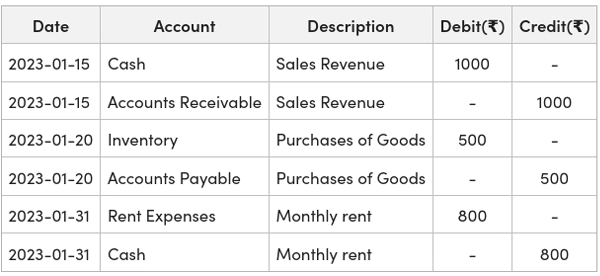

Ledger

Then, you need to transfer all the information from a journal to an accounting ledger. A ledger in accounting is a collection of all accounts that are recorded in a journal. Here is an image of a general ledger example!

Trial Balance

When the accounting period is all done, you need to prepare a trial balance to check whether all debit amounts are equal to the credits.

Methods of Bookkeeping

Apart from the two types of bookkeeping, there are two methods of bookkeeping, or, let’s say, parameters, that are used in the process.

Cash-based

Cash-based accounting means that revenues and expenses are only recorded when the actual cash is paid or received. This method is only used in small businesses and is very easy to manage and maintain.

For example, if you receive payment for a purchase in May, though it was sold in January, you will record it in May.

Accrual-based

In this method, a transaction is recorded when it occurs, no matter when the payment is made. For example, if you sell a product in March and the customer pays you in June, the transaction will be recorded in March.

Although this method is very challenging to maintain, it is also the one that gives you accurate details about the business’s financial condition. It is used in mostly large businesses, where even small transactions matter. Effective bookkeeping under this method also contributes to better cash flow management, especially when forecasting future income and expenses.

What is the Need for Bookkeeping?

Bookkeeping is a must for any business, be it for legal reasons or to keep the business up and running. Here, I’ve jotted down some of the common reasons why a business needs bookkeeping.

To Record Transactions

As I’ve said many times, the first objective of bookkeeping is to record every financial transaction in order based on when it took place. This way, all the recorded financial transactions will be up-to-date and can be used for future purposes.

Shows the Correct Position of Firms

In organizations, even petty losses and profits are considered a huge deal. With bookkeeping, accountants can easily analyze how the company’s expenses and profits have affected the business’s financial position during the year.

Detects Errors and Frauds

Since the bookkeeping records every financial event when it actually took place, it helps the company detect any errors or miscalculations in expenses and profits.

Helps in Decision-making

Once the company is able to assess its financial standing in the market through bookkeeping, it can plan what to do next. Be it buying more resources and inventory for the company or taking a loan from the bank for the business’s welfare.

Helps in Preparing Financial Statements

When all expenses and profits are recorded neatly, it helps companies prepare financial reports, which tell you the net worth of a company. These reports include a balance sheet, a cash flow statement, and an income statement. This process becomes especially important when preparing your year-end accounts to ensure compliance and accuracy.

Legal Requirement

As per various acts, a company or organization is legally required to maintain financial reports and books of accounts. And if you fail to keep such records, you might be charged for window dressing and misleading the stakeholders.

How to Start Bookkeeping?

If you are trying to get started with bookkeeping as a habit, you must follow these steps!

- Set up Bookkeeping software

Nowadays, bookkeeping is mostly done using software or tools. So, if you want to do the same, make sure to choose the right software from the many options, like Zoho Books, Xero, FreshBooks, etc.

- Choose the Accounting Method

Depending on your business size and your preference, you can choose from cash or accrual-basis accounting. If you have a small business, I recommend you go for the cash-based method, as it’s simple and requires less knowledge and time.

- Choose an Entry System

Next, you need to choose between the single-entry and double-entry bookkeeping systems. If you are looking for error-free records, a double-entry system would be a better choice; otherwise, you can choose single-entry.

- Categorize Your Transactions

Make sure every transaction is recorded in the books of account. It will help you with tax deductions and save you from trouble at the time of auditing.

- Choose a System to Store Documents

In accounting, keeping proof of your transactions plays a big role during audits. So, if you want to prevent your company from a disaster, make sure to keep digital records of transactions using tools like Dropbox, Evernote, or Google Drive.

- Be Consistent

It can be difficult to stick with bookkeeping, so remember to make time for bookkeeping and be consistent with it.

Are Bookkeeping and Accounting Different?

Since bookkeeping is often referred to as accounting, people often tend to confuse the two. Bookkeeping and accounting are two different terms, where the former is the basic step of accounting, while the latter is a broader approach.

Bookkeeping mainly involves recording financial transactions, while accounting includes analyzing, summarizing, reporting, and interpreting the recorded information.

Accounting includes:

- Analyzing the financial transactions of the business.

- Preparing financial statements (income statement and balance sheet).

- Communicating the information to stakeholders, like investors, creditors, etc.

- Analyzing the financial data to look for trends, problems, and opportunities.

Moving on, let’s take a look at the main differences between bookkeeping and accounting!

| Bookkeeping | Accounting |

| The purpose of bookkeeping is to keep systematic records of financial transactions. | The purpose of accounting is to provide reliable financial information to stakeholders and help them make decisions. |

| It is the base of accounting. | It uses the information recorded in bookkeeping to prepare financial statements. |

| Bookkeeping is just one part of accounting. | Accounting starts where bookkeeping ends. |

| The person who looks over bookkeeping is called a bookkeeper. | The person who looks over bookkeeping is called an accountant. |

| It is limited to the internal part of the firm. | It is widely available to both the internal and external parts of the firm. |

| High-level skills are not required. | Requires high-level knowledge of accounting and its various concepts. |

Further Read: Master Cost Accounting: Its Functions, Formulas, and Limitations

What Does a Bookkeeper Do?

A bookkeeper’s tasks mainly depend on the needs and type of business. Despite that, here are some common tasks a person in this position is required to do:

- Record financial transactions using accounting software, spreadsheets, and databases.

- Collect and organize financial records, cash flow statements, bank documents, and loss statements.

- Generate invoices and receive payments from customers.

- Track debits and credits for various accounts.

- Reconcile financial statements.

- Create balance sheets and income statements.

- Review reports for accuracy.

- Calculate and prepare payroll.

- File business tax returns and ensure compliance with tax laws.

- Other administrative tasks like communicating with clients and vendors, and monitoring the cash flow.

How Can You Become a Bookkeeper?

If you are someone who likes to deal with numbers and money, you might want to become a bookkeeper.

To become a bookkeeper, first, you need a bachelor’s or master’s degree in accounting or finance. However, if you don’t have a degree in any such field, you can opt for bookkeeping courses or certifications.

Remember that the average annual salary for a bookkeeper in the United States is around $50,000, though it may vary based on various factors.

Apart from that, you must also possess some necessary technical skills, like:

- Accountancy rules and acts

- Invoicing

- Billing

- Vendor relations

- Preparing accounts payable and accounts receivable

- Data entry

- Spreadsheets

- Payroll

- Financial statements

- Bank reconciliation

- Accounting software

Other than that, you should also consider:

- Taking a Bookkeeping Course

Although it’s not a must to have a degree in accounting or finance, it’s better to take a bookkeeping course to learn more about how to prepare reports, organize data, or use accounting tools.

- Getting a Bookkeeping Certification

A certification isn’t needed, but if you want to be on top of the shortlisted candidates, a certification course is necessary. It will give employers the idea that you are well-trained and have enough knowledge of accounting.

- Developing Workplace Skills

Apart from the technical skills I’ve mentioned above, you also need to develop some workplace skills, such as organization, communication, time management, error correction, decision-making, and critical thinking.

Wrapping Up!

That was all for “What is book keeping?”

Needless to say, bookkeeping is an important part of accounting that is dear to many businesses. It is the base part of an accounting cycle where every transaction is recorded in order to help companies realize their financial position in the market.

If you are interested in becoming a bookkeeper, I recommend you take online courses or earn a degree to improve your chances of being seen by employers!

Read Next: What is Retro Pay? Meaning, Examples, and How it Works

FAQs

Ans: Bookkeeping is the first step in the accounting process that includes recording and organizing financial transactions.

Ans: The average annual salary of a bookkeeper is $50,000 in the USA.

Ans: An accounting ledger is an account or record that summarizes and categorizes financial transactions recorded in the journal and gives a clear view of the financial position of a company.

Ans: Double entry accounting is a bookkeeping system where every financial transaction is recorded twice, once as a debit and once as a credit.

Source Links: