What is Petty Cash?: Explore its Meaning, Examples, Advantages, and Potential Challenges

Petty cash refers to the modest amount of money a business has on hand for small, immediate expenditures such as purchasing office supplies, paying parking fees, or covering minor snacks.

Whether you are a startup or running an established company, petty cash builds financial discipline and efficient accountability in the workplace. In an ever-evolving financial environment influenced by FintechZoom European Markets and FintechZoom CAC 40 trends, maintaining cash reserves for daily needs helps ensure operational efficiency.

Therefore, let’s begin with this article and learn more about its types, advantages, disadvantages, and effective recording methods more precisely.

- What is Petty Cash?

- What are the Different Types of Petty Cash?

- What are the Advantages and Disadvantages of Petty Cash?

- What is the Difference Between Petty Cash and Cash on Hand?

- How to Accurately Set Up Petty Cash Management?

- How to Effectively Record Petty Cash Transactions?

- What are the Potential Challenges With Petty Cash?

- Bottom Line

- Frequently Asked Questions

What is Petty Cash?

Petty Cash is a small amount that companies keep on hand to pay off the everyday expenses that are small or inconvenient to be settled by normal accounting methods.

To avoid the chaos of writing multiple cheques or giving access to credit cards to the employees, businesses kept the funds in the drawers, boxes, or big envelopes.

Remarkably, they are managed by the company’s custodian, also known as a petty cashier.

Furthermore, the petty cash funds are raised through periodic reconciliations and are also recorded in the financial statement, just like any other account transactions of the business.

Accordingly, it is categorized under the current assets on the balance sheet due to its easy accessibility, robust flexibility, and high liquidity.

What are the Examples of Petty Cash?

This fund covers several small, day-to-day company expenses, including:

- Buying office stationery like pens, notepads, markers, board pins, and the rest.

- Purchasing refreshments or snacks for employees.

- Paying for courier or postal charges.

- Covering parking and traveling expenses.

- Lastly, it is used to settle minor maintenance and repair costs, reimbursing an employee for a small purchase for office use.

What are the Different Types of Petty Cash?

In enterprises, each department gets allotted a separate petty cash based on its team requirements and the way it operates. Thus, here we have listed its various types. Take a look.

- General: It is used to pay off the basic expenses, like local travel, office supplies, postal charges, and minor maintenance reimbursements.

- Discretionary: This sort of petty cash is handed out to the team head or the manager to take care of certain employees’ requirements within set limits and the company’s policy.

- Emergency: Businesses kept some funds aside to handle the immediate, urgent expenditures that are limited and well-documented in the companies’ financial statements.

- Imprest: Lastly, this is a fixed-amount system in which the actual balance is restored after every cycle.

Therefore, the aforementioned types of petty cash help businesses to track and record their entire miscellaneous expenses promptly.

Suggested Read: Understanding Reverse Charge VAT: Concept, Benefits, Challenges, and Application

What are the Advantages and Disadvantages of Petty Cash?

Pretty cash is one of the convenient approaches that helps businesses manage the small expenditures without affecting the overall funding of the company. However, it also comes with several potential risks that you should know.

Thus, in this section, we have presented its advantages and disadvantages. Check them out.

| Advantages | Disadvantages |

| Petty cash is a quick and convenient way to pay for the basic, everyday expenses of the company. | There is a high risk of mismanagement and fraud due to the flexible and easy access to petty cash. |

| It significantly reduces the administrative burdens by keeping a moderate amount aside. | It may lack the comprehensive tracking of funds, which makes it difficult for financial analysis. |

| This approach helps businesses to maintain their financial workflow more effectively. | Keeping cash openly at the workplace may increase the chance of theft. |

| The petty cash handles the minor or unexpected expenses, which eventually improves the overall cash flow system of the company. | |

| Lastly, by allowing employees to use this fund for covering the small, approved items helps boost their morale and work efficiency. |

In a nutshell, petty cash is a simple and handy way to handle everyday expenses, but it requires proper supervision to avoid any sort of risk associated with it.

Also Read: What is Retro Pay? Meaning, Examples, and How it Works

What is the Difference Between Petty Cash and Cash on Hand?

Petty cash and cash on hand might seem similar at first, but they both serve different purposes. Thus, below, we have illustrated the key difference between them. Read it attentively.

| Petty Cash | Cash on Hand |

| This refers to the limited physical money (bills and coins), which is allotted by the company. | This refers to the total amount of physical money, including cash in the register, petty cash, and all other cash. |

| The main objective of this fund is to cover the minor, everyday expenses of the business. | The primary objective of this fund is to cover all the immediate cash requirements and unexpected expenses for the employer and employees. |

| It is managed and tracked by one appointed custodian (petty cashier) by the company’s administrative department. | It is tracked by the individual or one designated employee known as the custodian. |

| The physical money is kept in the drawer, lock box, or envelope. | The cash is kept in the safe locker or in the cash register. |

| Example: A $100 cash kept in the drawer to cover the expense of the snacks for the employee’s meeting. | Example: Along with the $100 of petty cash, more money is kept aside with it to pay off the unexpected expenses like major repairs or travelling abroad. |

Simply put, cash on hand is a term that represents the complete physical money of the business, whereas petty cash is one of its part that handle the day-to-day expenditures of the employees.

How to Accurately Set Up Petty Cash Management?

Allotting funds for petty also incorporates some basic rules, so that they can be managed appropriately. Check out the pointers below to learn more about it.

- Appointing a Professional Custodian (Petty Cashier): The funds raised to handle the miscellaneous expenditures come under the supervision of the custodian of the company. Ensures the person is skilled in the accounting capabilities and knows how to manage, track, and record the assets.

- Finalize the Funding Amount: In the imprest system, companies decided upon a fixed amount as the funds for petty cash. Thoroughly analyze your team’s requirements and secure a funding source, making it a convenient option to manage small expenses.

- Secure the Allotted Funds: After enterprises release the funds to the custodian, it’s time to safeguard the cash in the lock box, drawer, or cabinet file to avoid any sort of fraud or theft.

- Establish Expense-Centered Policies: Binding the funds is a must to ensure that the company’s money is used for the predetermined, limited, and approved expenses, avoiding unnecessary or extra payments.

- Maintain a Proper Disbursement Record: The custodian should prepare an accurate cash flow statement of all the expenditures with the essential details like date, time, and more, for effective financial analysis.

- Implement the Receipt Process: Besides maintaining the logs, it will be beneficial to maintain a record of the bills or receipts for every expense. This will make it easy to track payments and help to avoid any kind of fraud or theft.

In short, petty cash comes with high flexibility and liquidity, but it is important to manage and track it like any other financial asset of the business to make the most out of it.

How to Effectively Record Petty Cash Transactions?

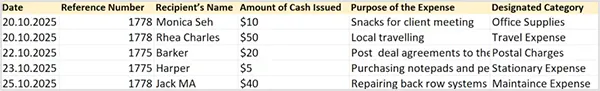

Firstly, create a log or a spreadsheet to record all the entries of cash movements, ensuring an accurate and reliable accountability of the company’s funds.

Accordingly, the petty cashier is the one responsible for paying off the expenses and recording them with the following details:

- Date

- Reference number (Petty cash voucher)

- Recipient’s name

- Amount of cash issued

- Purpose of the expense

- Designated category

Therefore, collect and attach the receipts and bills of these expenses along with this spreadsheet, providing the balanced and reliable records of the used funds.

What are the Potential Challenges With Petty Cash?

Petty cash may seem a small part of the company’s finances, but managing it comes with its own set of challenges. Below, we have listed some possible complications businesses have to deal with. Take a look.

- High Chances of Fraud or Misuses: As there are no firm restrictions or tracking, it is likely possible employees may use these funds for their personal use or for unapproved expenses.

- Improper Recording of Funds: Misplacing the receipts of the expenses or a lack of disbursement is common in the petty cash approach. This can lead to the possible imbalance between the physical and recorded funds, harmfully affecting a company’s overall finances.

- Time-Consuming Reconciliation: Managing funds, tracking payments, and collecting expenses’ receipts from all employees can be difficult and protracted, especially in large enterprises.

- Funds Security: Securing cash from theft or mishandling is one of the serious challenges in the petty cash approach. It required constant monitoring, tracking, and awareness to ensure safety.

- Lack of Accountability: Making precise bookkeeping covering all the small expenses is a little tedious. Businesses may have to deal with contradictions between financial reports and physical assets, or may also with the anonymous expenses and missing funds.

- Avoiding Overuse of the Allotted Funds: Without any specific guidelines, there is are high chance of excessive use of the handy money by the employees on unapproved or personal benefits. This may impact the business’s entire cash flow and lead to potential losses at the end of the repayment period.

Overall, to protect your finances from the above-mentioned challenges, ensure you have hired a dedicated and professional petty cashier and also introduce effective policies to bind the funds with some limitations. This will help you reduce the chances of fraud or misuse and enhance petty cash management.

Bottom Line

Wrapping up! Petty cash is one of the advantageous financial approaches that helps businesses to manage their day-to-day expenses without impacting the overall assets.

However, this financing technique may come with some possible challenges, but once you comprehend how to manage them, it can actually reduce the burden of handling the minor expenditures.

Next Read: Breaking Down the Ashcroft Capital Lawsuit: Allegations, Responses & Possible Impact

Frequently Asked Questions

Ans: This refers to the moderate, handy amount that businesses usually keep aside to settle the minor, immediate, and everyday expenses. For instance, buying snacks for an employee meeting, organizing events, purchasing office supplies, and the rest.

Ans: This term refers to the custodian who has been authorized by the company’s administration to manage, spend, and track the funds raised for the minor expenses.

Ans: It is considered an asset of the business because the remaining balance after the payment period stays in the company’s hands and can be used to settle future expenditure.

Ans: No, there is no fixed amount or threshold decided for this financial approach, as it depends on the company’s size and requirements. For example, a small business typically allocates $500 to $1000 for minor expenses, whereas large companies may set aside $5000 to $10,000 for the same.

Ans: Yes, it is determined as the current liability on the financial statement of the business, as it consists of liquid cash that can be immediately used to cover the expenses.