Washington Sales Tax: Learn About Local and Washington Sales Tax Rate, Nexus Laws, and Filing Requirements

Washington state calls for booming opportunities for businesses but also demands proactive measures towards the Washington sales tax system. Unlike other states that charge bonus tax rates on personal income, this state collects the funding for education, infrastructure, healthcare, and public services from sales taxation.

Whether you own a boutique, restaurant, or e-commerce store, knowing the WA state sales tax rate helps to stay compliant and build market credibility. We have explained what is the sales tax in the state of Washington, local laws, and requirements are in this guide. So read the entire blog and take notes!

- What is the Sales Tax in the State of Washington?

- Types of Washington Sales Tax

- State and Local Sales Tax Rates

- What are Nexus Laws?

- Sales Tax Washington: Penalties for Non-Compliance

- Things You Need for Washington State Sales Tax Compliance

- How to Report to Sales Tax Washington and Prepare for Audits?

- Wrapping Up!

- FAQs

What is the Sales Tax in the State of Washington?

Washington state is a hub for growing businesses and provides ample opportunities for every company level to thrive. The only important aspect is to keep up with the sales tax rate, which starts at 6.5%. The cities and other counties in the state charge local tax up to 3.9%, which, when combined, increases as high as 10.4% in Edmonds and Seattle.

Here’s the thing: unlike other states, Washington follows a destination-based tax system. Meaning, the taxes are levied not where the business is located but where every order or service is delivered. This makes it hard for businesses to track the tax rate based on the state they are shipping to or providing service to.

Digital services, digital products, construction, and goods are all taxable items and require vigilance for taxation to avoid penalties and to ensure you charge the fair amount. Learn how Invest1Now.com cryptocurrency trends are affecting business decisions.

Types of Washington Sales Tax

This state has a layered sales tax structure that every small to large business needs to stay up to date with. Understanding the types of Washington state sales tax 2024 and future on, helps to price the product or services fairly and be credible to apply for government policies. These are the types of state of Wa sales tax you should know about:

- State Sales Tax: The standard sales tax rate is 6.5% which is imposed on taxable services and retail and wholesale. This charge has to be paid by every business that is functional in the state, unless there are any exemptions.

- Use Tax: This type of tax is applied to businesses that use, store, and consume taxable items from out-of-state businesses that don’t pay into the Washington tax system. For example, you have a construction business and source equipment from another state, so in that case, you have to self-report and pay use tax. (Similar to California exit tax for out-of-state transactions.)

- B&O Tax: Business and occupation taxes are levied on gross receipts. It plays an important role in the state tax system and is calculated based on a business’s activity and gross revenue. Check out how Life2Vec crypto investments influence state-level compliance.

Understanding the types of state of Washington state sales tax is as significant as making business decisions. It not only supports in avoiding misclassification and penalties but also helps to make the right financial strategies to comply with the government and boost revenue.

State and Local Sales Tax Rates

Every state and county in Washington charges its own local tax, which fluctuates the overall combined rate. Thus, a person in Seattle will have to pay different charges than someone in Clarkston.

The government instructs every citizen and business owner to stay up-to-date with the Washington Seattle tax rate to have a better understanding of pricing and compliance.

We have an updated list of the combined Washington state sales tax, 2024 for each city:

| City | Combined Sales Tax Rate ( as of 2024) |

| Othello | 8.20% |

| Clarkston | 8.20% |

| Kennewick | 8.60% |

| Wenatchee | 8.40% |

| Port Angeles | 8.80% |

| Vancouver | 8.60% |

| Dayton | 8.10% |

| Longview | 8.40% |

| East Wenatchee | 8.40% |

| Republic | 8.10% |

| Pasco | 8.60% |

| Pomeroy | 8.10% |

| Moses Lake | 8.20% |

| Aberdeen | 9.00% |

| Oak Harbor | 9.00% |

| Port Townsend | 9.10% |

| Seattle | 10.25% |

| Bremerton | 9.20% |

| Ellensburg | 8.40% |

| Goldendale | 8.20% |

| Centralia | 8.20% |

| Davenport | 7.80% |

| Shelton | 8.90% |

| Omak | 8.40% |

| Raymond | 8.30% |

| Newport | 8.10% |

| Tacoma | 10.20% |

| Friday Harbor | 8.10% |

| Mount Vernon | 8.80% |

| Stevenson | 8.40% |

| Everett | 10.40% |

| Spokane | 8.90% |

| Colville | 8.10% |

| Olympia | 9.40% |

| Cathlamet | 8.20% |

| Walla Walla | 8.90% |

| Bellingham | 9.10% |

| Pullman | 8.50% |

| Yakima | 8.20% |

What are Nexus Laws?

A nexus is a concept that determines whether the state recognizes the business for collecting and remitting sales tax. Even if you have a physical store, with this indicator, the state keeps track of your business’s whereabouts and how you operate.

Physical Nexus

If your business has any tangible belongings in the state, it will be counted under physical nexus. This will include:

- Owned or rented warehouse, office, workshops, or retail store.

- Having a sizeable inventory and equipment in the state.

- Employees and agents working in the state.

These things create an obligation for businesses to register with DOR and obtain certifications for legal operations.

Economic Nexus

The state has enforced economic nexus laws, which state that your business is liable to pay taxes regularly even if you do not have a physical location of operations. However, it has a threshold that is calculated based on annual transactions. If any retail store exceeds $100,000, it has to file monthly taxes.

The reason Nexus laws matter is that they help to maintain fair competition in the marketplace, prevent tax avoidance by the sellers, and ensure fair deals and pricing. Businesses like Biitland.com crypto show how these rules impact online revenue collection.

Sales Tax Washington: Penalties for Non-Compliance

The state tax system is quite serious about collecting taxes, and failing to report taxes timely can be costly for your business’s financial health. Moreover, the state has laid down certain penalties that owners have to pay, which puts their reputation and operations at stake.

Failure-to-File Penalties

This applies when you fail to submit tax reports by the deadline, and the interest rates increase until the proper filing is done.

- 1–30 Days Late: 5% penalty on the due amount.

- 31–60 Days Late: 15% interest on the tax due.

- More than 61 Days: 25% penalty charged on the tax due.

Failure-to-Pay Penalties

Not paying penalties and filing the reports triggers the charges further and can cost up to 29% monthly. The charges keep on increasing until you pay the entire amount with accurate documents.

Fraud and Intentional Misreporting

If any business intentionally underpays taxes, the DOR determines the issues and charges a 50% penalty over the unpaid amount. Moreover, the consequence can escalate to criminal charges and revocation of business permits.

Audit Risks and Record-Keeping Requirements

If the company continues to underpay taxes, the DOR orders an internal audit, where the business has to submit proper financial reports for four or more years. The discrepancies can lead to back taxes with hefty interest rates, civil penalties, and revocation of licenses.

Check Out: 5starsstocks .com Review: Is It the Right Tool for Your Portfolio?

Things You Need for Washington State Sales Tax Compliance

Complying with the tax rules is not a one-time thing. It is a part of your business process that you’ll have to do and abide by over and over again. So, in order to do it right, these are the few essential things that you need:

- Register your business with the Washington Department of Revenue (DOR) to receive proper licenses and permits.

- Keep your Sales Tax Permit Number handy for receipts and invoices. This number is only obtained after the governing body recognizes your business.

- You must understand the Nexus rules and check whether your business has economic nexus. This strengthens the tax foundation of your company.

- As Washington follows destination-based tax rates, you must have a POS system that automatically calculates tax rates to correct the pricing of products or services.

- Your invoices and customer receipts must mention total cost, sales tax amount, and exemptions.

- You must know which products and services are taxable and which qualify for exemptions. You can find the reports on the government website.

- The laws suggest filing for tax liability before the 25th day of the month. Missing the last date leads to penalties and extra charges.

Having these essential things in place, you can safeguard yourself and your business from unnecessary risks and audits. Other tools, such as Ecryptobit.com NFT and Fintechzoom.com European Markets, provide additional insights for businesses navigating taxation.

How to Report to Sales Tax Washington and Prepare for Audits?

The work doesn’t just end with collecting the rates of sales tax in Washington state; you’ll have to file proper documents and fees accurately and always be proactive in keeping the business accounting records. Here are a few things business owners need to do to complete the entire process seamlessly:

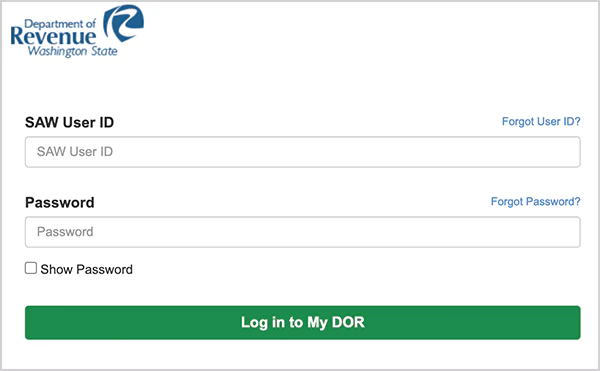

Registration to Collect Taxes

The first step for every type of business is to register itself with the Washington Department of Revenue to receive business permits and licenses. To do so, you can visit mydor.com’s official site and create your user ID and password to log in to your business account.

Filing Schedule

The frequency of filing totally depends on the annual revenue of the business. These are the certain timelines you must follow:

- Monthly Reporting: Necessary if your company generates over $1.08 million per year in taxable sales.

- Quarterly Submission: Designated if taxable income falls between $150,000 and $1.08 million per year.

- Yearly Submission: It is permissible if the taxable income is below $150,000 each year.

You can also file tax reports frequently with a zero return, just to be compliant with the laws. Other references for audits and financial planning include Fintechzoom.com Bonds and Fintechzoom.com Loans.

The Filing Procedure

- First, log in to the My DOR portal.

- Here, select the time period for your return. It can be monthly, quarterly, and annually.

- Calculate and enter your gross sales with documents.

- Write all the claims, deductions, and exemptions, like hospital bills and groceries.

- Based on your input, the system will automatically show the Washington sales tax rate for your location.

- Review and report any out-of-state purchases that are taxable.

- That’s it, make the payment electronically.

Keep Records for Audits

According to Wa sales tax laws, every business needs to keep track of 4 years of accounting for correct auditing. Failing to provide the documents can lead to criminal charges and penalties. As a business owner, here are things you must keep safe:

- Sales invoices and customer receipts.

- Certificates of customer exemption.

- Evidence of sales tax gathered and submitted.

- Buy invoices (particularly for goods liable to use tax).

- Records of payroll and total earnings (for B&O tax adherence).

If you follow these steps vigilantly, along with maintaining a proper record of your business’s accounting, you will always be on the good side of sales tax in Washington laws.

Wrapping Up!

If you run a business in Washington, it is a responsibility to fulfill the state of Washington sales tax for smooth operations. The base tax rate is 6.5% and understanding the local tax rate and policies helps avoid penalties and compliance issues.

We have explained all about sales tax Washington state, nexus laws, and local tax rates in this blog. We hope this information will help your business to align with the government policies and taxation rules. For further insights, check Fintechzoom.com Gold and MyFastBroker.com.

Read Next: Fintechzoom.com CAC 40 – Introduction, Companies, Future Outlook, Recent Trends, and More

FAQs

Ans: The standard WA state sales tax rate is 6.5%. However, the addition of local taxes can increase the overall sum to 10% in some areas.

Ans: No, Washington has sales tax, which is the combination of state and local taxes in the US.

Ans: Yes, Washington has a local sales tax that lies between 0.5% to 4% and varies for cities and counties.

Ans: Washington state charges 7% of capital gain for profiting from some asset classes over $250,000.

Ans: Washington State has no policy and charges no tax on income; thus, the sales tax helps to fund the public services and state infrastructure.

Sources: