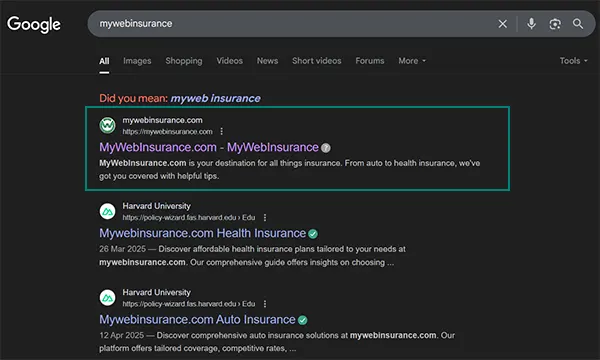

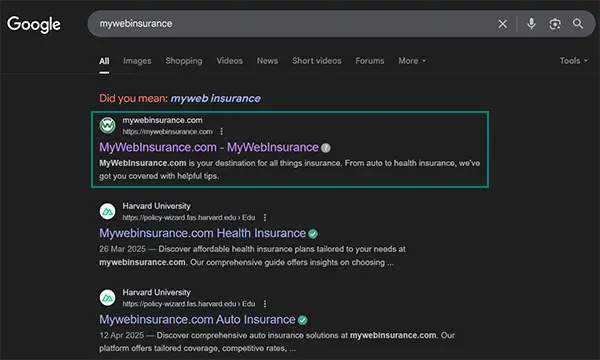

Mywebinsurance.com Business Insurance – Know Everything About This Safety Net

Whether you’re an owner of a small or big business, purchasing a safety net to safeguard your company is one of the smartest moves in today’s unpredictable world.

And that’s exactly where the role of mywebinsurance.com business insurance comes in. This innovative organization promises to grant a wide range of coverage and assistance during your tough time.

You can protect your business from damage, theft, loss of physical assets, and unforeseen legal proceedings. Therefore, without any ado, let’s begin with a blog post to learn more about this insurance partner in depth.

- What is Mywebinsurance.com Business Insurance? Why Does it Matter?

- What are the Different Coverage Available at Mywebinsurance.com?

- Types of Tailored Solutions Provided by Mywebinsurance.com

- Key Benefits of Choosing Mywebinsurance.com

- What are the Different Factors That Affect the Insurance Rate at Mywebinsurance.com?

- Process of Getting a Quote From Mywebinsurance.com

- Process of Claim and Support at Mywebinsurance.com

- Bottom Line

- Frequently Asked Questions

What is Mywebinsurance.com Business Insurance? Why Does it Matter?

Mywebinsurance.com business insurance is a protection shield that safeguards your business from the potential losses that may occur due to unexpected events like accidents, lawsuits, natural disasters, and the rest.

Eventually, this helps you to cover the cost of damage or legal fees so that your business funds won’t suffer— something every accounting for startups owner should keep in mind.

Therefore, whether you’re a small business or a large-scale established organization, business insurance gives you peace of mind. So that you can focus on your growth without stressing about the possible risks.

Briefly, this safety net ensures stability, safety, and is ready for anything you may have to face ahead.

What are the Different Coverage Available at Mywebinsurance.com?

It is entirely important for you to understand what sort of insurance may protect your business. There are several options available at mywebinsurance .com, and each of them has distinct roles in managing risk— much like understanding accounts payable vs accounts receivable in finance.

Let’s check them individually.

- General Liability Insurance: This is the basic insurance policy. It covers the injury and damage claims. For instance, protects the organization in lawsuits.

- Property Insurance: Complete coverage for financial losses caused because of the physical assets. It covers damages that occur due to fire, natural disaster, and theft.

- Workers’ Compensation: According to the many state laws, majorly businesses must have this insurance for their employees’ safety and to provide further benefits.

- Business Interruption Insurance: One of the powerful insurance coverages that helps businesses when they fail to run because of a disaster. It covers the entire damage cost.

Thus, above, we have mentioned four different types of coverage for you. So that you can easily comprehend what will align with your business requirement perfectly, read them attentively.

Read More: Debits and Credits Cheat Sheet: Understand Accounting Essential Concepts in a Few Minutes

Types of Tailored Solutions Provided by Mywebinsurance.com

Mywebinsurance.com business insurance experts team understands that every business is different and requires its own personalized insurance coverage to protect it from liability.

And because of that, they offer several coverage plans such as life, auto, health, pet, home, and business insurance.

Let’s examine them individually in depth.

Business Insurance

Mywebinsurance.com business insurance is specially designed to protect your company from the unpredictable events that could cause huge financial losses to you.

Whether you own an established brand or are the owner of a small shop, having the right insurance is extremely important for you. It can provide you the financial support in situations like property damage, theft, and legal proceedings. Choosing the right plan is as critical as knowing your fixed cost and variable cost structure.

There are various sorts of coverage available at the official website of mywebinsurance.com. You can visit the site for free and comprehend these different attributes of policy anytime, anywhere.

Apart from that, these plans are affordable, and you can also customize them and rearrange the pricing according to your budget and personal needs.

In short, having an insurance policy for your business is not just an option; it has now become a necessity to protect what you have worked hard for. This policy provides financial security in your tough times and long-term success.

Life Insurance

Life insurance is a coverage you can purchase to establish financial stability for your loved ones after you. It’s as vital to your personal finances as understanding your tax identification number UK obligations.

Simply put, this is a legal contract between an individual and an insurance company, which covers the daily expenses, business debts, or educational expenditures of your beneficiary after your death.

You can choose the plan according to your preference and budget by simply visiting mywebinsurance.com online website, which makes the entire process simple, fast, and stress-free.

Auto Insurance

Auto insurance refers to the coverage that protects both your personal and business vehicles. Their plans cover damage, theft, accidents, and even medical expenses if someone gets injured.

Whether you are commuting daily or occasionally, mywebinsurance .com has flexible policies for you. Consequently, you can choose the plan for you and your vehicle, or add coverage for third parties.

Lastly, this innovative insurance policy ensures you instant assistance, so you won’t be stuck in expensive repairs or legal troubles after an accident.

Health Insurance

Apart from the business or physical assets, protecting your valuable funds from the expensive medical bills is also important. The health of mywebinsurance.com business insurance took care of that.

In this plan, you may get complete cost coverage for your regular doctor visits, hospital expenses, and medical checkups. You can pick the plan and customize it according to your requirements and budget.

Purchasing health insurance from this amazing company helps you manage your medical bills and stay financially stable no matter what life brings to you— just like maintaining a healthy cash flow statement in business.

Pet Insurance

Being an animal lover or having a furry friend, you should at least consider purchasing this pet insurance offered by mywebinsurance .com.

With the help of this plan, you can take care of your pet without worrying about the pricing of treatments. It may cover things like accidents, surgeries, and even the regularly scheduled check-ups.

So, whether you have a fluffy dog or a mischievous cat, pick the plans based on your expectations and financial capabilities.

Home Insurance

A home insurance plan can effectively protect your house and personal belongings from theft, damage, and disasters, which may include floods, storms, and fire.

In this, you can choose the plan that covers the complete cost of repairs, replacement, and temporary living expenses in case your insured apartment becomes inadequate for occupancy.

So, if you own a place or live in an apartment, you can attain the benefits of the policy according to your specific needs, provided by mywebinsurance.com renter insurance.

Overall, at mywebinsurance.com, you can find several tailored solutions that furnish the protection not only to your business, but also safeguard your health, house, and vehicle. Simply, there is something for everyone, and that’s what makes this company an outstanding and trustworthy one. Similar to safeguarding assets on your accounting equation, it keeps your investments protected.

Suggested Read: Tax Accounting: Definition, Types, Importance, Methods, and Effective Steps to Calculate

Key Benefits of Choosing Mywebinsurance.com

Having a reliable and strong insurance partner for you and your business is extremely significant for your safety, growth, and financial stability.

And for that, choosing mywebinsurance .com is a smart move one can make in today’s unpredictable times. It offers an affordable and personalized safeguard shield for every area of your life. Financial security is as important in insurance as in managing retained earnings for long-term business growth.

Moving forward, here we point out some primary benefits you can attain from the mywebinsurance.com company. Take a look.

- Simple Online Process: Visiting its official website, reviewing different policy options, and getting to the final stage of buying the plan is entirely easy and simple. You can perform the process on your computer and phone effortlessly.

- Affordable Plans: The company offers several flexible plans, also you can customize them according to your requirements, which can perfectly fit your budget.

- Range of Insurance: At mywebinsurance .com, you can find a wide range of insurance. This may include coverage for business, life, auto, health, pet, and home liability insurance.

- Instant Claims Support: Unlike other insurance partners, mywebinsurance.com promises the fastest claim service so that you can get instant financial help in your tough times.

- Transparent Policy Terms: The mywebinsurance.com makes sure that they maintain transparency from the initial stage, so that you can get a clear idea about the policy terms of the plan you are going to purchase.

Therefore, if you are looking for simple, stress-free, and secure financial support, consider buying the policies from this outstanding company.

What are the Different Factors That Affect the Insurance Rate at Mywebinsurance.com?

When buying a policy, the premiums you have to pay or the interest rate are not the same for everyone. Several factors significantly bring the changes in the insurance rate— similar to how debt financing impacts your company’s financial risk.

Understanding these factors will save you from spending more money and will assist you in customizing your policy more precisely.

Moving further, examine the table below to know more about the factors that play an important role in the insurance rate, and every business should know about them.

| Factors | Impact on Insurance Rates |

Type of Business | Rising businesses like construction are more likely to pay higher rates than lower companies like consulting. |

| Size of Business | Larger businesses often have to pay more due to more employees. |

Locality | Locations where climatic changes occur more frequently, or the possibility of accidents and crimes, have higher premiums. |

| Coverage | The higher coverage means more protection, but it comes with a higher cost. |

| Safety Measures | Businesses that acquire safety measures may benefit from the discounts. |

In a nutshell, apart from the aforementioned factors, there might be more things that directly affect the insurance rates. It is important to understand and compare the different factors so that you can get better coverage at a lower price.

Also Read: Corporate Accounting: Definition, Importance, Types, and Career Potential in 2025

Process of Getting a Quote From Mywebinsurance.com

Getting the quote from this impressive organization requires a few taps and 3–4 minutes of your time. But first, make your mind clear about what you need to be covered in the policy and how much you can spend on this. Knowing these is as essential as understanding what is bookkeeping for your business finances.

After that, read the following steps to learn how to get a quote from mywebinsurance.com business insurance.

- Visit the official website of this organization.

- Register yourself by using your business email address and mobile number.

- Fill out the required information in the given boxes.

- Click on the “Get Quote” option.

- After getting the industry-specific quotation, customize the plans by adding the particular coverage and removing something that you don’t need.

- Click on the purchase button.

- Lastly, finish the payment process.

At the end, you will get the mail on your registered email address, and from there you can verify your insurance details like policy number, premium sum, due date, and the rest.

Also Read: Is Accounts Receivable an Asset or Liability? Here’s the Detailed Answer

Process of Claim and Support at Mywebinsurance.com

Unlike other companies, mywebinsurance.com business insurance streamlines the process of claiming and ensures that its clients get the beneficial assistance, especially on their hard days. Having clear documentation works much like preparing accurate payslip records for employees — it speeds up the process.

Just like the procedure of purchasing the policy from this innovative organization, the claiming process is easy and fast.

Therefore, check out the steps below to learn how you can easily ask for help and claim your plan.

- Visit the official website of mywebinsurance.com.

- Log in to your account.

- Look for the claim section on the dashboard.

- Fill out your information accurately and upload the required documents.

- Submit your claim application for further processing.

In essence, by adhering to the aforementioned steps, you can easily seek help from the company. Remember, you need to be patient for a while, as they will shortly reach out to you through email and will provide all the updates.

Bottom Line

Wrapping up! In business, having a secure partner is essential to being prepared for any sort of unexpected problems.

Regardless of the size of your company, knowing that you have a strong shield to support and protect you from risks will empower you to act more confidently in this competitive world.

At last, we just want to say, protecting your hard work is as important as expanding it. So, take your time, do not rush, comprehend all the information about mywebinsurance.com business insurance carefully, and then come to any final decision. Just as a sound insurance plan protects against unexpected losses, maintaining smart financial practices like reverse charge VAT compliance keeps you secure from regulatory risks.

Next Read: 15 Common Cash App Scams: Learn How to Avoid Scams in 2025

Frequently Asked Questions

Ans: Yes, making this company your insurance partner is entirely safe. The purchasing process is simple and fast, and they promise to provide instant help at the time of the claim.

Ans: Getting a quote from this company is easy. You can visit its official website and customize the plans according to your requirements.

Ans: By purchasing the business coverage from this company, you can enable complete coverage for damages, theft, or loss of physical assets that may occur due to unexpected events.

Sources: